Buying a brand-new condo in Ottawa is exciting—no previous owners, modern finishes, and the chance to move into a home that’s completely your own. But if you think buying pre-construction is as simple as picking a unit and waiting for it to be built, think again.

New build condos come with a different set of rules, risks, and rewards compared to resale units. If you’re considering buying pre-construction in 2025, here’s what you need to know to make the right decision.

1. The Reality of Pre-Construction Timelines

Let’s start with the biggest thing that catches buyers off guard: delays.

Developers love to market a sleek new condo with an estimated move-in date, but in most cases, that date will get pushed back—sometimes by months, sometimes by years.

Why do delays happen?

Labour shortages – Ottawa’s construction industry is stretched thin.

Supply chain issues – Some materials still take longer to arrive post-pandemic.

Permitting and inspections – The city can slow things down depending on the project.

Financing problems – If a developer doesn’t sell enough units early on, lenders may stall construction.

💡 Pro Tip: Always assume the original completion date is optimistic. If you need to move within a strict timeline, a pre-construction condo may not be your best bet.

2. Deposits & Payment Structure: What to Expect

Unlike a resale condo, where you typically put 5%–20% down, new build condos require deposits in stages.

A common structure looks like this:

✔ 5% at signing

✔ 5% after 30 days

✔ 5% after 90 days

✔ 5% at occupancy

Some developers offer more flexible payment plans, especially for first-time buyers. If you’re short on cash but want to secure a unit, look for a builder offering extended deposit structures.

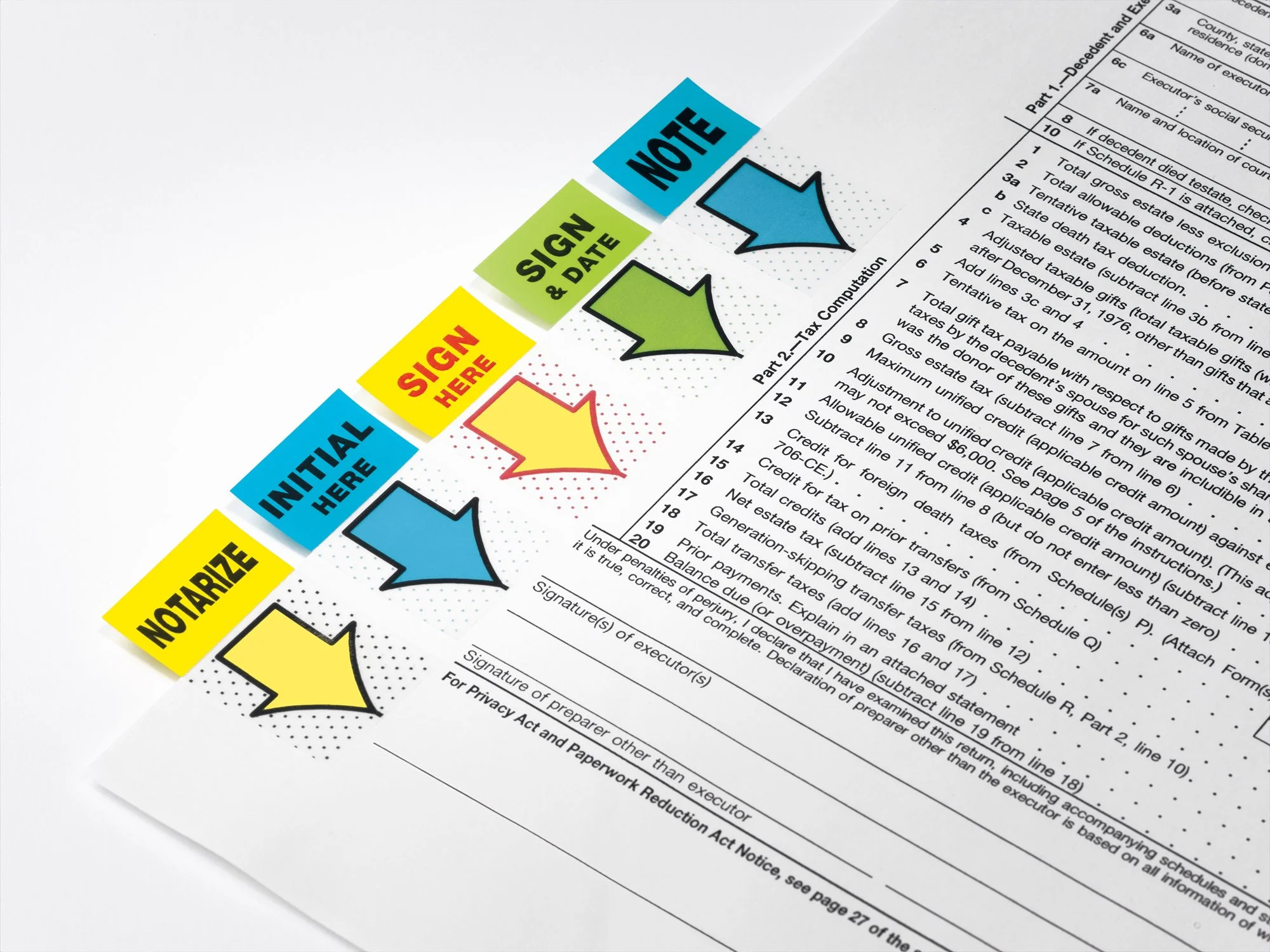

💡 Pro Tip: Your deposit is held in trust and protected by Ontario’s Tarion Warranty Program, but always work with a lawyer to review the contract before you sign.

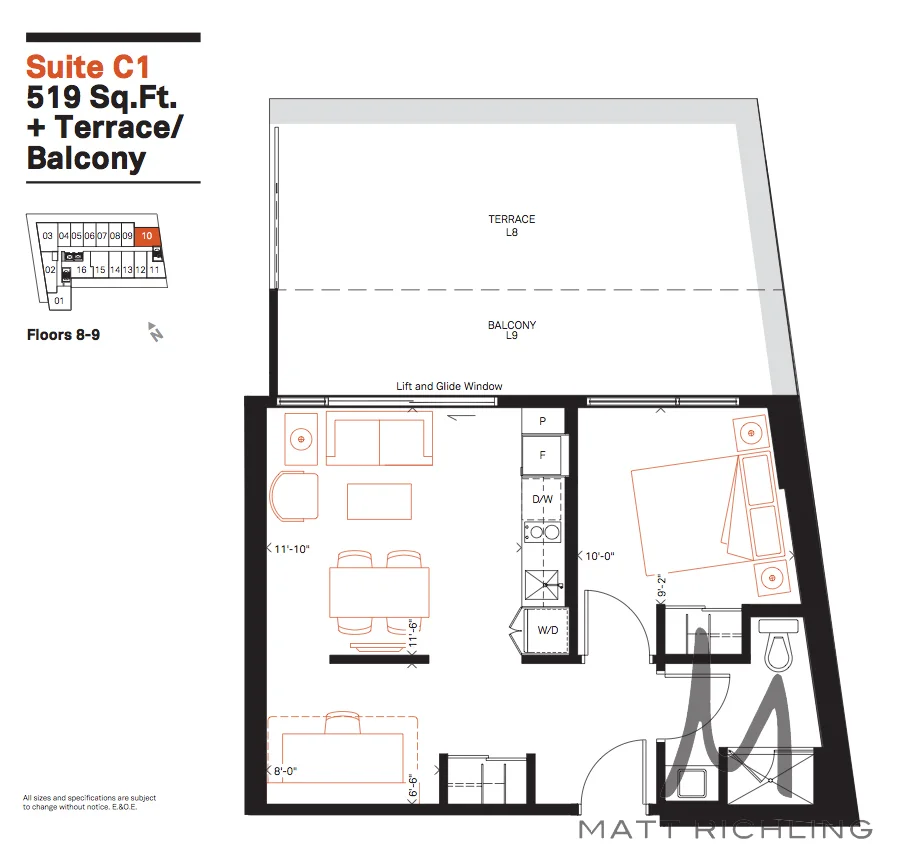

3. What You See Isn’t Always What You Get

That stunning model suite you toured? That’s the developer’s best work. Your actual unit might look a little different.

Common surprises include:

❌ Standard finishes that don’t match what was shown in the showroom

❌ Missing light fixtures or outlets in unexpected places

❌ Layouts that slightly shift due to building constraints

Builders will offer upgrade packages, but those costs can add up quickly. Even basic changes like switching to quartz countertops or upgrading flooring can cost thousands.

💡 Pro Tip: Get everything in writing. If you expect soft-close cabinets, higher ceilings, or upgraded fixtures, make sure they’re in your contract—not just something the sales rep said.

4. Interim Occupancy: You Pay Before You Own

One of the most confusing parts of buying a pre-construction condo is interim occupancy.

This happens when the building is ready for people to move in, but the condo isn’t officially registered yet. During this time, you don’t actually own your unit—instead, you pay the developer a fee to live there (basically like rent).

Interim occupancy can last several months before the final closing, meaning you could be paying for a condo you don’t technically own yet.

💡 Pro Tip: Budget for interim occupancy costs and ask upfront how long it’s expected to last.

5. Hidden Costs Buyers Forget About

Beyond your purchase price, there are a few extra costs that can sneak up on new build buyers:

✔ Development Charges & Closing Costs – New builds come with extra fees that aren’t part of resale transactions. These can be thousands of dollars and are often capped (or should be—make sure your contract specifies a limit).

✔ HST on Investment Properties – If you’re buying a condo as an investment, you may have to pay HST upfront (though you can apply for a rebate).

✔ Condo Fee Estimates Are Just That—Estimates – Developers often list low condo fees to attract buyers, but expect them to increase once the building is fully occupied.

💡 Pro Tip: Negotiate closing cost caps. Many buyers don’t realize they can limit how much they’ll pay in extra fees—make sure this is in your agreement.

6. Resale Value: Are You Actually Getting a Deal?

Not all new build condos appreciate equally. Some buildings skyrocket in value after completion, while others struggle to compete with resale units when it comes time to sell.

✔ Buildings in high-demand locations (Westboro, Centretown, Little Italy) tend to appreciate better.

✔ Boutique buildings with unique architecture hold value better than cookie-cutter towers.

✔ Well-managed condos with lower fees are always in demand.

💡 Pro Tip: Research resale values of past projects by the same developer—if their last building isn’t holding its value, think twice before buying.

7. Assignment Sales: Selling Before You Close

If you buy pre-construction but change your mind before closing, your only option is to sell your contract in an assignment sale—basically, selling the unit before it’s built.

✔ Some builders allow assignments, some don’t.

✔ You may have to pay a fee to the developer to sell your unit.

✔ You’ll be competing with other assignment sellers.

With resale condo prices rising in 2025, some buyers are making a profit selling assignments, but it depends on the project and market conditions.

💡 Pro Tip: If you think you might need to sell before closing, make sure your contract allows for an assignment sale—not all do.

Is Buying a New Build Condo in Ottawa a Smart Move in 2025?

It depends on your timeline, budget, and risk tolerance.

✅ Buy pre-construction if:

✔ You want a brand-new home with modern finishes.

✔ You have flexibility in your move-in date.

✔ You can afford to wait for potential delays.

✔ You’re looking for a long-term investment in a growing area.

❌ Consider a resale condo instead if:

✔ You need certainty on move-in timing.

✔ You want to avoid unexpected closing costs.

✔ You prefer to see exactly what you’re buying.

New build condos can be a great investment—but only if you understand the risks and know what to expect.

Thinking about buying a pre-construction condo in Ottawa? Let’s talk. The right strategy can help you find a unit that fits your lifestyle and investment goals.