What the Data Really Says (Jan 1 – July 21, 2020–2025)

If you’re trying to understand what’s really happening in Ottawa’s real estate market, not Kemptville, Arnprior, Rockland, or Renfrew, this is for you. Most stats lump the city in with outlying towns, which can distort the numbers and mislead both buyers and sellers.

This post focuses strictly on City of Ottawa data: detached homes, semis, townhomes, condo apartments, and condo townhomes; tracked across six years from January 1 to July 21. We’ve zeroed in on how the market has moved since the 2021 sales peak and 2022 price peak, and where things stand today in 2025.

Detached Homes – Pricing Has Nearly Fully Recovered

In 2022, detached homes in Ottawa hit their highest-ever average price: $976,701. That peak didn’t last — prices fell to $878,269 in 2023, a sharp -10.1% drop.

But as of July 2025, the average detached price has climbed back to $905,980; up +3.2% from last year, and only -7.2% below the 2022 peak. The market hasn’t fully bounced back, but it’s close. Detached homes are leading Ottawa’s pricing recovery.

Semi-Detached – Quiet but Strong Climb Back

Semi-detached homes peaked in 2022 at $801,503, before dropping to $750,064 in 2023; a -6.4% dip. As of 2025, the average price is up to $773,485, gaining back most of the loss and now just -3.5% below the peak.

This segment isn’t flashy, but it’s quietly one of Ottawa’s best-performing property types for price stability and recovery.

Townhomes – Affordability Wins Again

Ottawa townhomes reached $695,859 in 2022, then dropped to $619,916 in 2023; a -10.9% slide. In 2025, they’ve rebounded to $628,922, regaining most of that lost ground and proving their appeal among budget-conscious buyers.

With back-to-back year-over-year price increases and a strong floor under values, townhomes continue to be one of the most stable segments in Ottawa real estate.

Condo Apartments – Still Lagging Behind the Pack

Condo apartments hit a high of $461,155 in 2022, but took a hit in 2023, falling to $437,305. In 2025, they’re up slightly to $444,366, still -3.6% below the peak.

What’s more telling: sales volume has dropped off a cliff. In 2021, over 2,100 condo apartments sold in Ottawa. In 2025? Just 1,144; a -45.7% drop. Oversupply, rising rates, and reduced investor appetite continue to challenge this segment.

Condo Townhomes – Underrated and Holding Steady

In 2022, condo townhomes averaged $479,798. They dipped to $431,167 in 2023 and have since crept back to $436,712 in 2025. That’s still ~9% off the peak, but the consistent upward trend speaks to strong affordability and utility.

This is the workhorse segment; not flashy, but reliable. With relatively shallow declines and steady pricing, condo townhomes are a smart choice for families who need space but not the detached price tag.

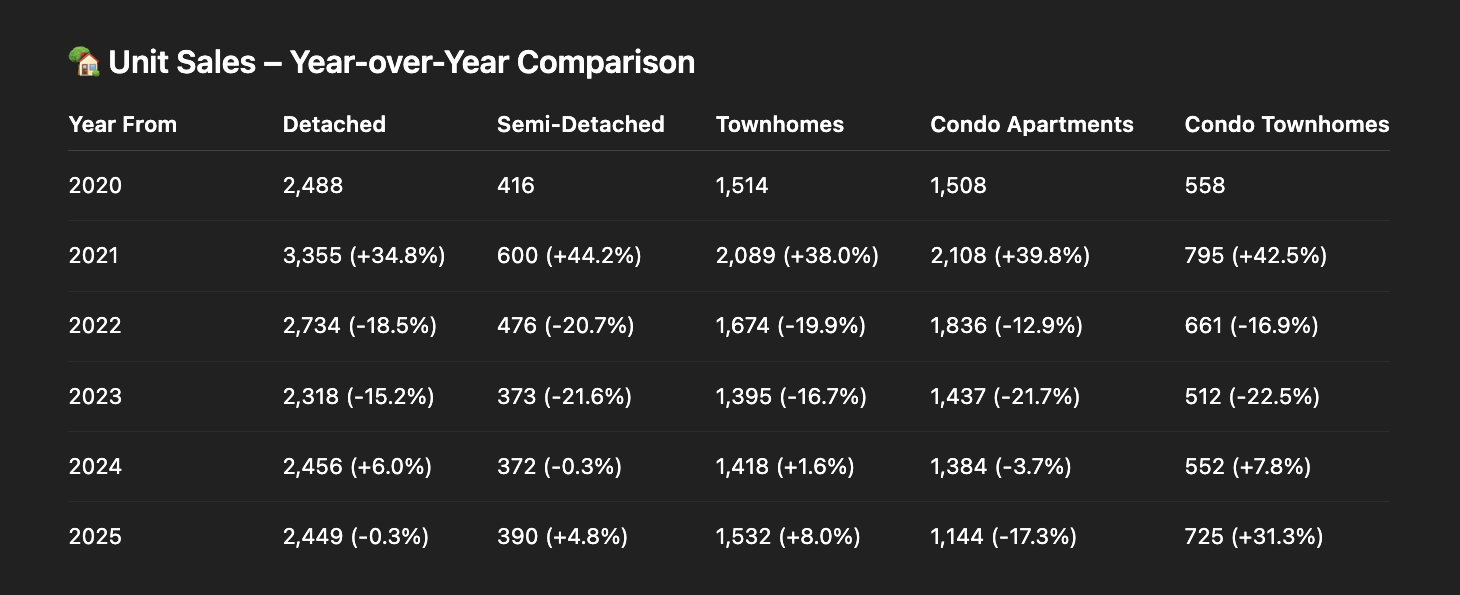

Unit Sales – The 2021 Frenzy Is Long Gone

Remember the pandemic peak? Here’s how 2021 compares to 2025 in actual sales volume:

Detached homes: 3,355 (2021) → 2,449 (2025) ↓27%

Semi-detached: 600 → 390 ↓35%

Townhomes: 2,089 → 1,532 ↓26.6%

Condo apartments: 2,108 → 1,144 ↓45.7%

Condo townhomes: 795 → 725 ↓8.8%

The urgency of 2021 is gone. Buyers are more selective, more budget-aware, and they’re negotiating harder. The volume shift confirms this: demand didn’t disappear, it just normalized.

Days on Market – A Slower, Healthier Market

Back in 2021 and early 2022, properties flew off the shelf in under two weeks. Fast-forward to 2025 and the average days on market (DOM) has more than doubled:

Detached homes: 10 → 26 days

Semi-detached: 11 → 25 days

Townhomes: 8 → 26 days

Condo apartments: 17 → 43 days

Condo townhomes: 9 → 31 days

This isn’t a sign of weakness — it’s a return to balance. Buyers can take their time. Sellers need smart pricing strategies. And agents have a real opportunity to add value again through marketing and negotiation.

Final Take: Ottawa Has Stabilized — and That’s a Good Thing

From 2020 to 2022, Ottawa’s market exploded. From 2023 to 2024, it reset. And in 2025, we’re now seeing clear signs of recovery in nearly every segment — especially detached, semis, and townhomes.

Most property types have regained nearly all of their 2022 value

Sales volume is down, but demand remains steady

Buyers and sellers are on more equal footing

If you’re expecting a crash, you’re waiting for something that already happened and was corrected. Ottawa’s market is no longer red-hot… but it’s far from cold.

It's stable. It's balanced. It's what a sustainable real estate market is supposed to look like.

Want Hyper-Local Stats?

If you'd like information based on the town, suburb, or specific neighbourhood you currently live in, or are thinking about moving into, just let me know. I can break down the data for your exact area so you can make confident, informed decisions in today’s market.

- Mitch

Mitch MacKenzie

mitch@mattrichling.com