Every month we take a closer look and drill down the sales data of Ottawa condos from the previous month. Here are the statistics for February 2026 in the top five "downtown" areas - Centretown, Byward Market and Sandy Hill, Little Italy (which includes Lebreton Flats), Hintonburg, and Westboro. The information will be specific to apartment-style condominiums, and only what is sold through the MLS. Also important to note that DOM (Day's On Market) is calculated to include the conditional period, which in Ottawa is roughly 14 days for almost every single transaction.

Ottawa Housing Market Update: February 2026 Shows Early Signs of Transition

Ottawa’s housing market remained relatively quiet through February, continuing the slower winter activity we saw earlier in the season. While overall sales were lower than typical February levels, the numbers suggest the market may be beginning to shift as we move toward the spring season.

Rather than a uniform slowdown, the data shows different patterns across property types. Condo prices are starting to strengthen, townhomes remain the most active segment, and single-family homes are holding steady despite fewer transactions overall.

If these trends continue, Ottawa could enter the spring market with balanced conditions and steady demand.

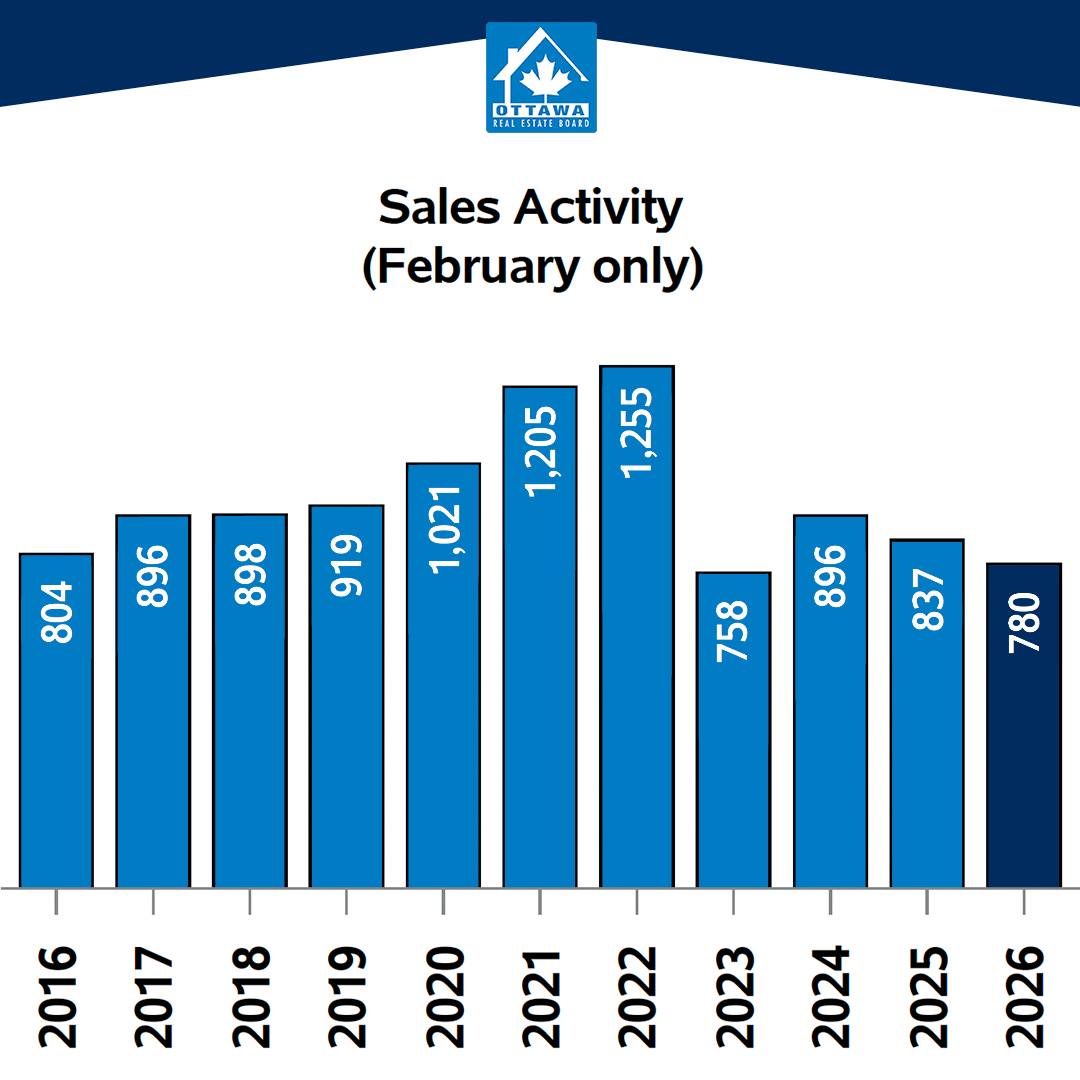

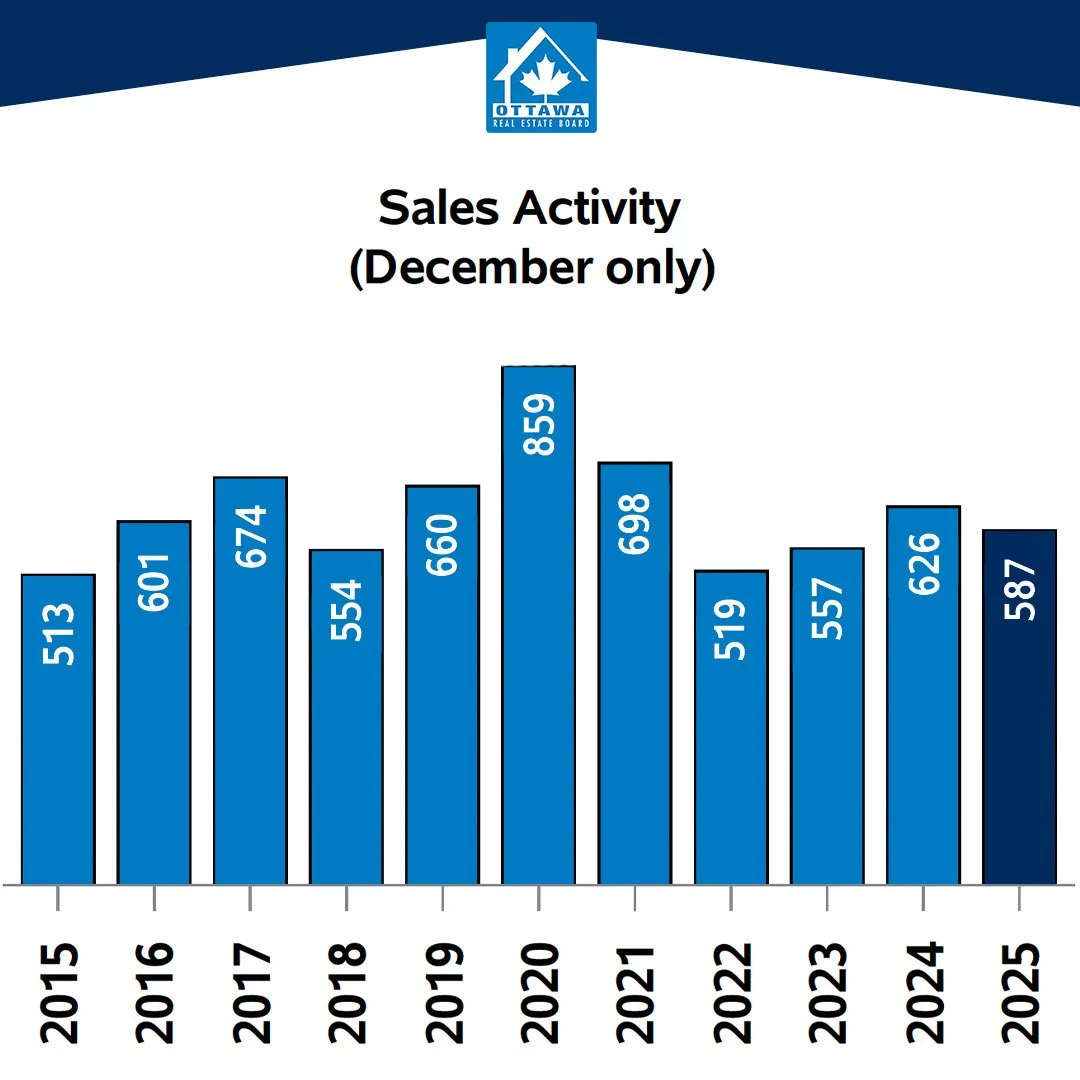

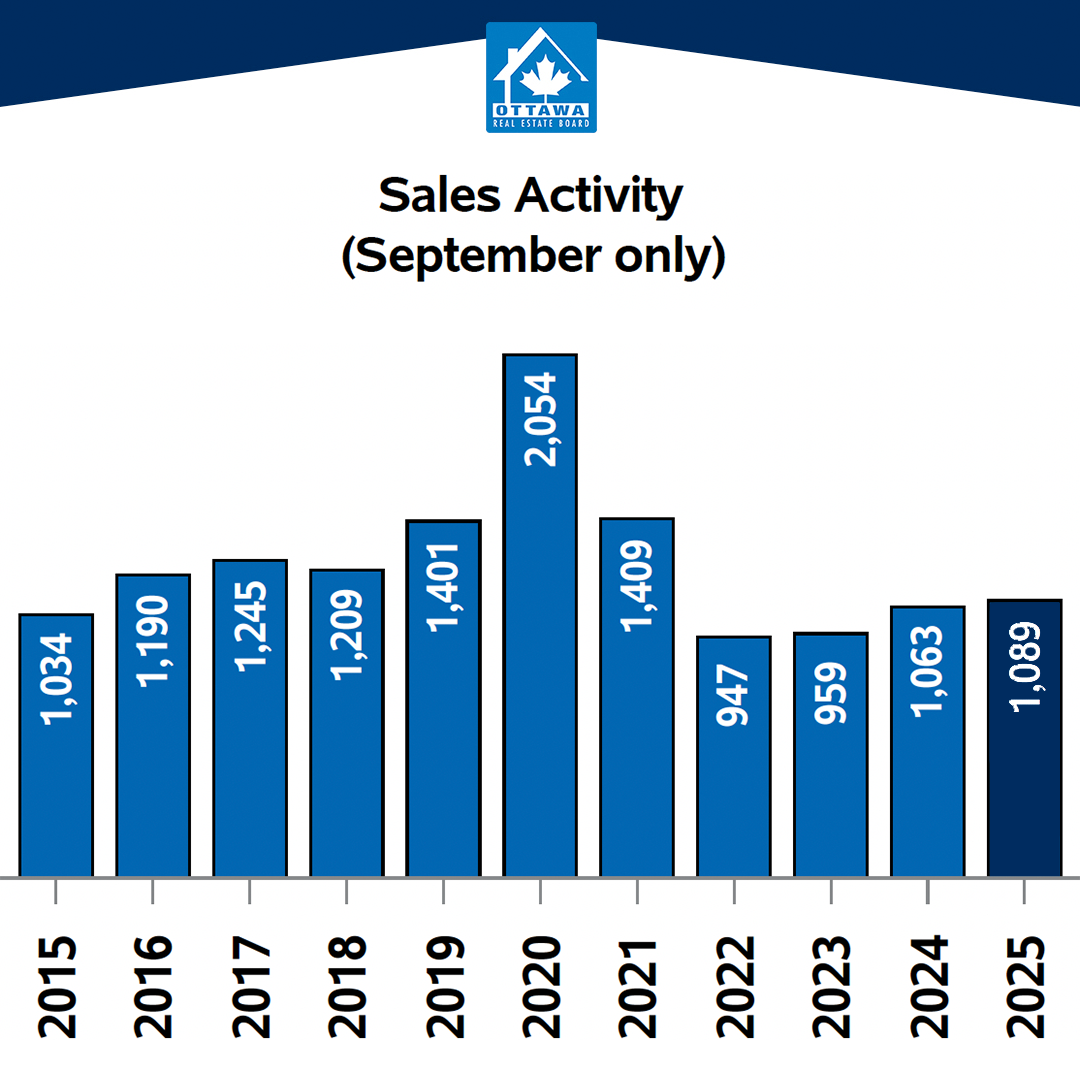

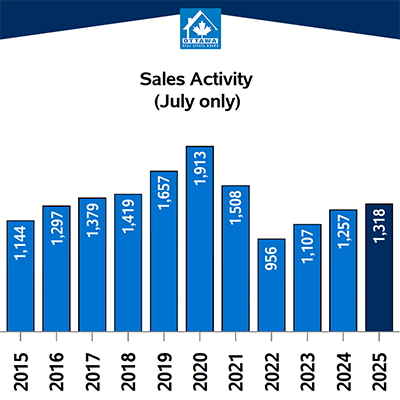

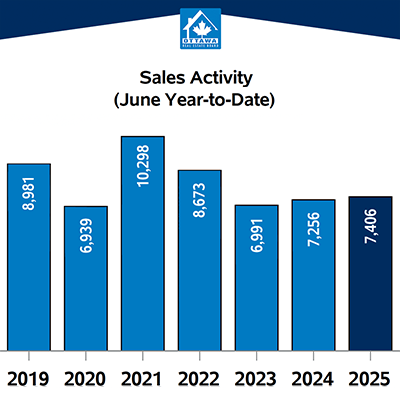

Residential Sales Activity in Ottawa

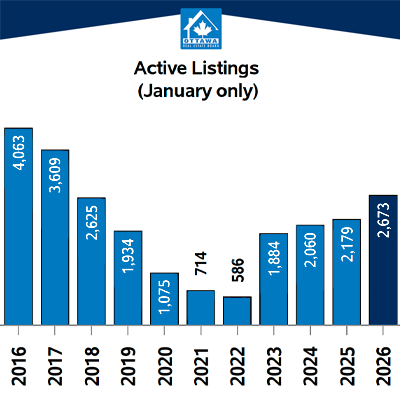

A total of 780 residential properties sold in Ottawa in February. That represents a 6.8 percent decline compared to February 2025. While this is still well below the five-year February average of 990 sales and the ten-year average of 949, activity did improve from January’s 610 transactions.

This places the current winter among the slower markets Ottawa has seen in the past decade. However, slower sales do not mean demand has disappeared. Buyers are still active, particularly in more affordable price ranges, but they are taking longer to make decisions due to higher inventory levels and ongoing affordability considerations.

The average residential sale price in February was $662,773, which is down 1.0 percent year over year. The median price came in at $615,450, a decline of 3.1 percent compared to last year. These price adjustments remain relatively modest and reflect a market adjusting to increased supply rather than a significant downward trend.

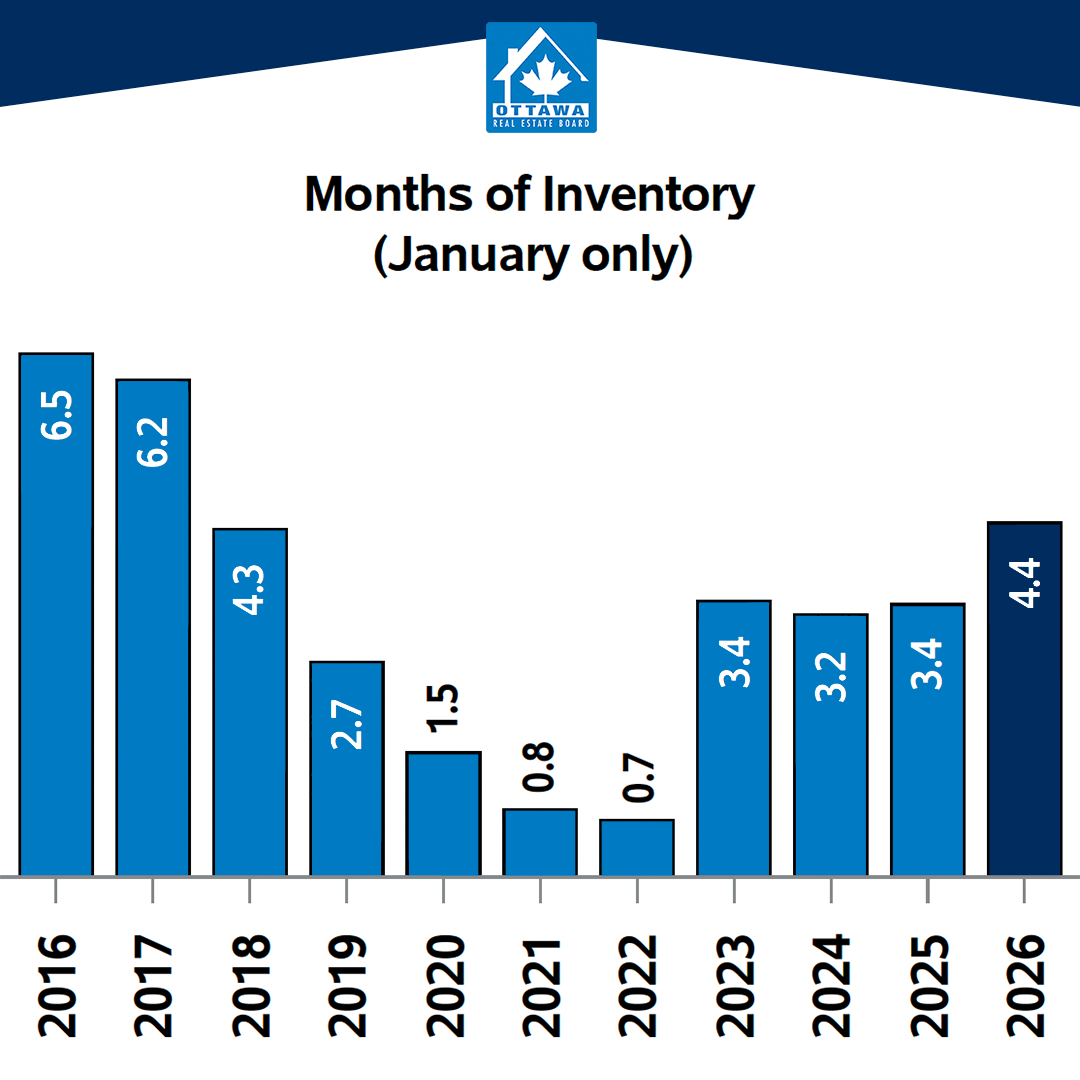

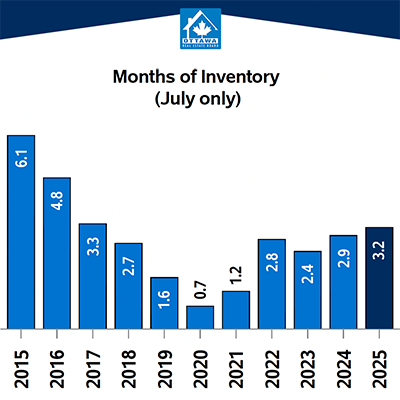

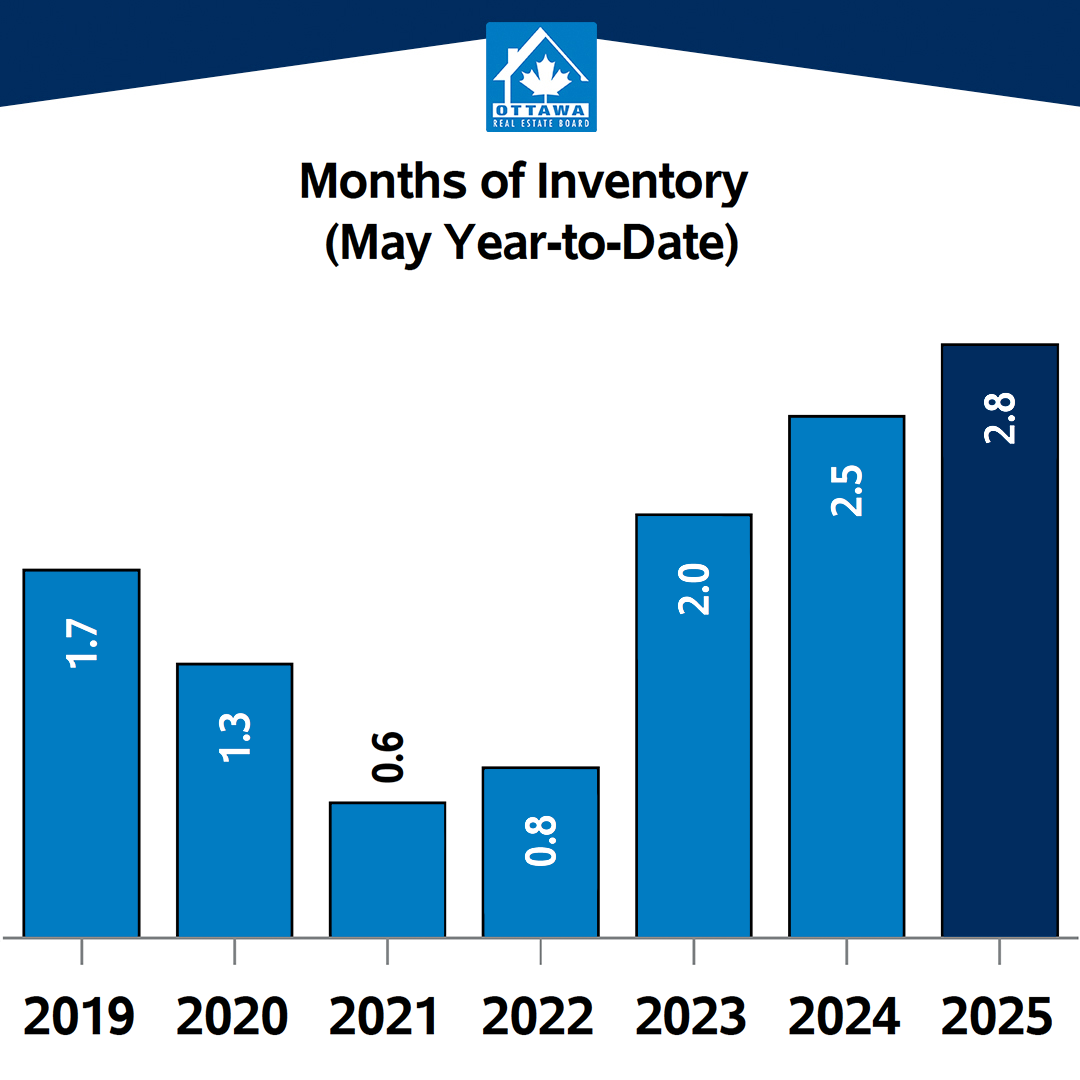

Inventory levels also shifted during the month. Months of inventory declined to 3.8 from January’s 4.4 as sales activity picked up slightly. This places Ottawa firmly in balanced market territory.

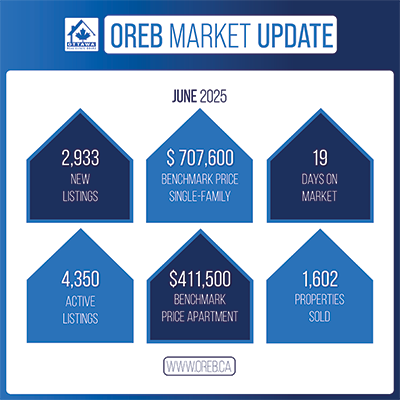

Benchmark Prices Show Month-to-Month Improvement

The MLS Home Price Index provides a clearer look at underlying price trends because it accounts for seasonality and differences in the types of homes sold.

In February, benchmark prices increased month over month across every major property category including single-family homes, townhouses, and apartments. While benchmark values remain slightly below levels seen one year ago, the monthly increase suggests that pricing momentum is beginning to return as the market approaches the spring season.

Condo apartments, in particular, are showing early signs of improvement after carrying elevated inventory levels since late 2025. At the same time, townhomes continue to experience the strongest turnover of any property type, even as rising inventory puts some pressure on prices. Single-family homes remain relatively stable overall.

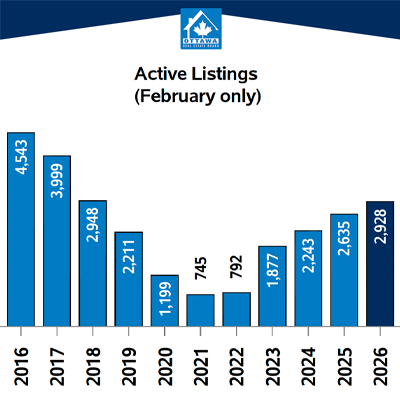

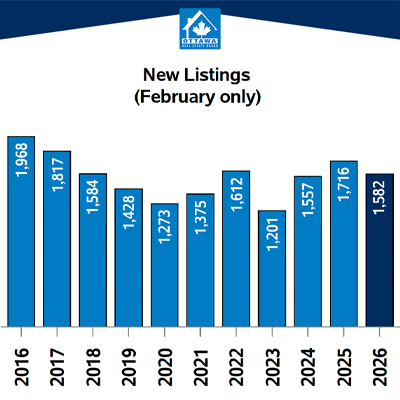

Inventory Levels and Market Balance

New listings in February totaled 1,582 properties. This represents a 7.8 percent decrease compared to February 2025, but a slight increase from January’s 1,522 new listings.

At the end of the month, Ottawa had 2,928 active residential listings, which is an 11.1 percent increase year over year and higher than what we typically see for February.

The larger pool of available homes is giving buyers more options and reducing the urgency that defined the market in previous years. At the same time, sales activity and rising benchmark prices suggest demand remains steady.

When looking at months of inventory by property type, the numbers highlight the differences across segments:

Single-family homes: 3.8 months of inventory

Townhomes: 2.7 months of inventory

Apartment-style condos: 5.6 months of inventory

These figures reinforce the idea that Ottawa is currently operating in a balanced market, with some segments tighter than others.

What This Means for the Ottawa Market Heading Into Spring

February’s data continues to reinforce what we first saw in January. Ottawa’s housing market appears to be moving through a period of transition.

The winter season has been slower than in recent years, but several indicators point to stable demand beneath the surface. Benchmark prices are rising month over month, condo inventory is beginning to be absorbed, and townhome sales remain strong.

According to the Canadian Real Estate Association, demand is expected to gradually strengthen throughout 2026 as borrowing costs ease and confidence improves. Ottawa’s recent market activity aligns with that outlook.

If demand continues to build as we move toward spring, the current inventory levels could support a more active market while still maintaining balanced conditions. That would create opportunities for both buyers and sellers as the market enters its busiest time of year.

Important to note is that these statistics can only be as accurate as there are condos sold in Ottawa. The more condos sold in an area, the more accurate the averages will be.

Want to chat about your options? Fill out the form at the bottom of the page, or text/call us directly at 613-900-5700 or fill out the form at the bottom of the page.

Do you have any questions about how this information affects your investment or looking for more information to make the best decision about your purchase? Let’s chat! Fill out the form on the bottom of the page.