Matt Richling: What is the new program?

Peter Rostocki: The new incentive is aimed to increase affordability and get people more buying power if you are in a household that has an income of $120,000 and below. The idea is that the first time buyer who's household is $120,000 and below is typically capped by how much they can afford because obviously, they have to fit into the ratios (ratios are TDS or Total Debt Service, GDS or Gross Debt Service - essentially how much you make vs expenses). With this new program, it gives the FTB additional buying power because the government is giving them additional down payment funds that increase how much they can buy. So, if previously you are limited to 5% down on a purchase of $450,000 now you can buy something for $475,000/$480,000 with 5% down because the other 5% is going to come via the grant program. My opinion is that the main goal here is to allow people whose income is $120,000 and below to have more options. Keep in mind that the incentive will provide 5% additional down payment if it’s a resale property or 10% additional down payment if it’s a new construction property.

M: Who Qualifies?

Anybody that qualifies under the mortgage insurers’ current criteria. The criteria hasn’t changed, all of the existing rules and qualifications stay the same, but now this is above and beyond that. The main 3 qualifiers for the program are;

1. You need to have the minimum down payment to be eligible.

2. Your maximum qualifying income is no more than $120,000.

3. Your total borrowing is limited to 4 times the qualifying income.

M: Where do consumers go for details?

P: Here is the link to the official government website that takes you through the steps;

https://www.placetocallhome.ca/fthbi/first-time-homebuyer-incentive

M: Who would qualify that might not think that they do?

P: Somebody who hasn’t done the application to the new standards because they're based it on a pre-approval from two years ago. I get calls from a client where they say they were pre-approved last year. That is great, but before we even go past the conversation of anything, get the details on that pre-approval and let's do a new pre-approval with today's rules. So much has changed over the last year, even!

M: Who should take advantage of the new incentive?

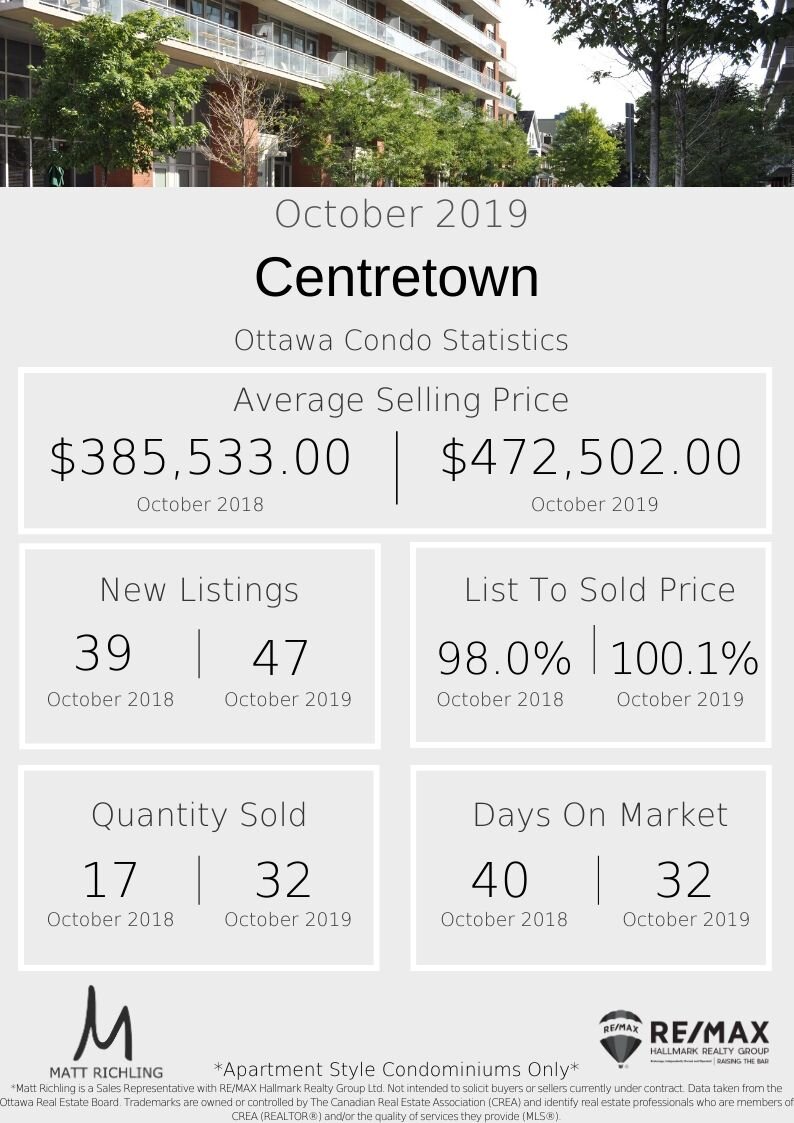

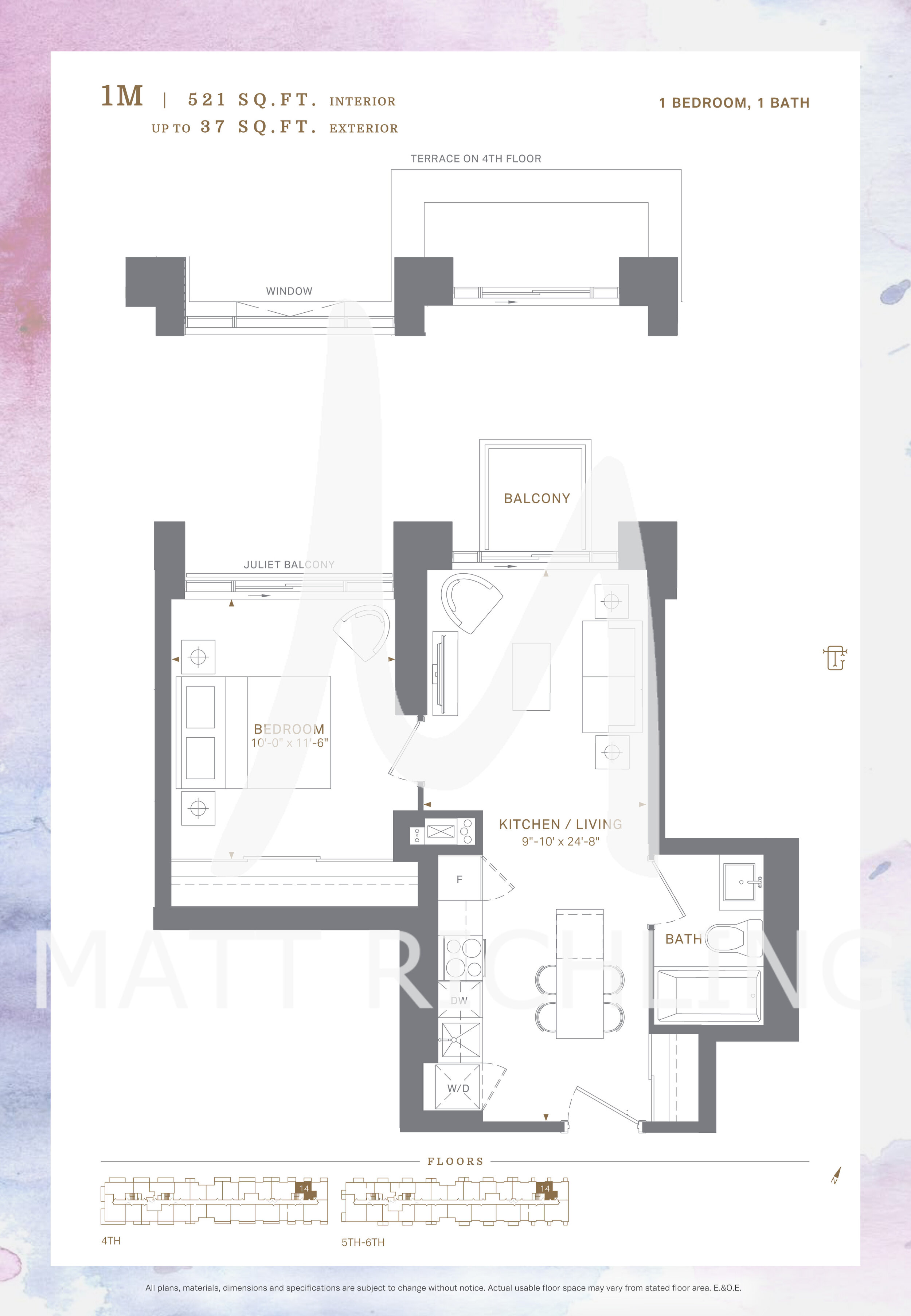

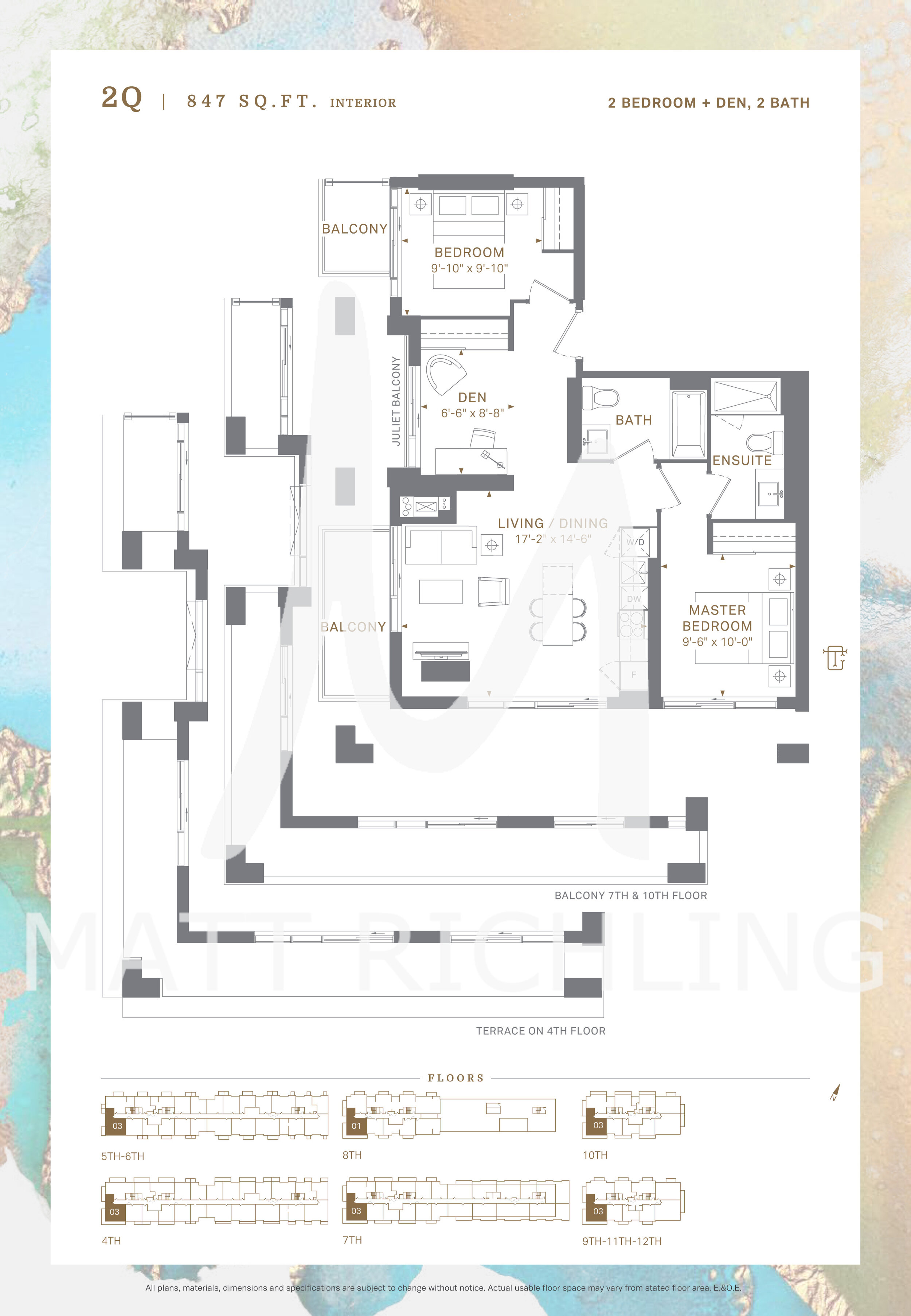

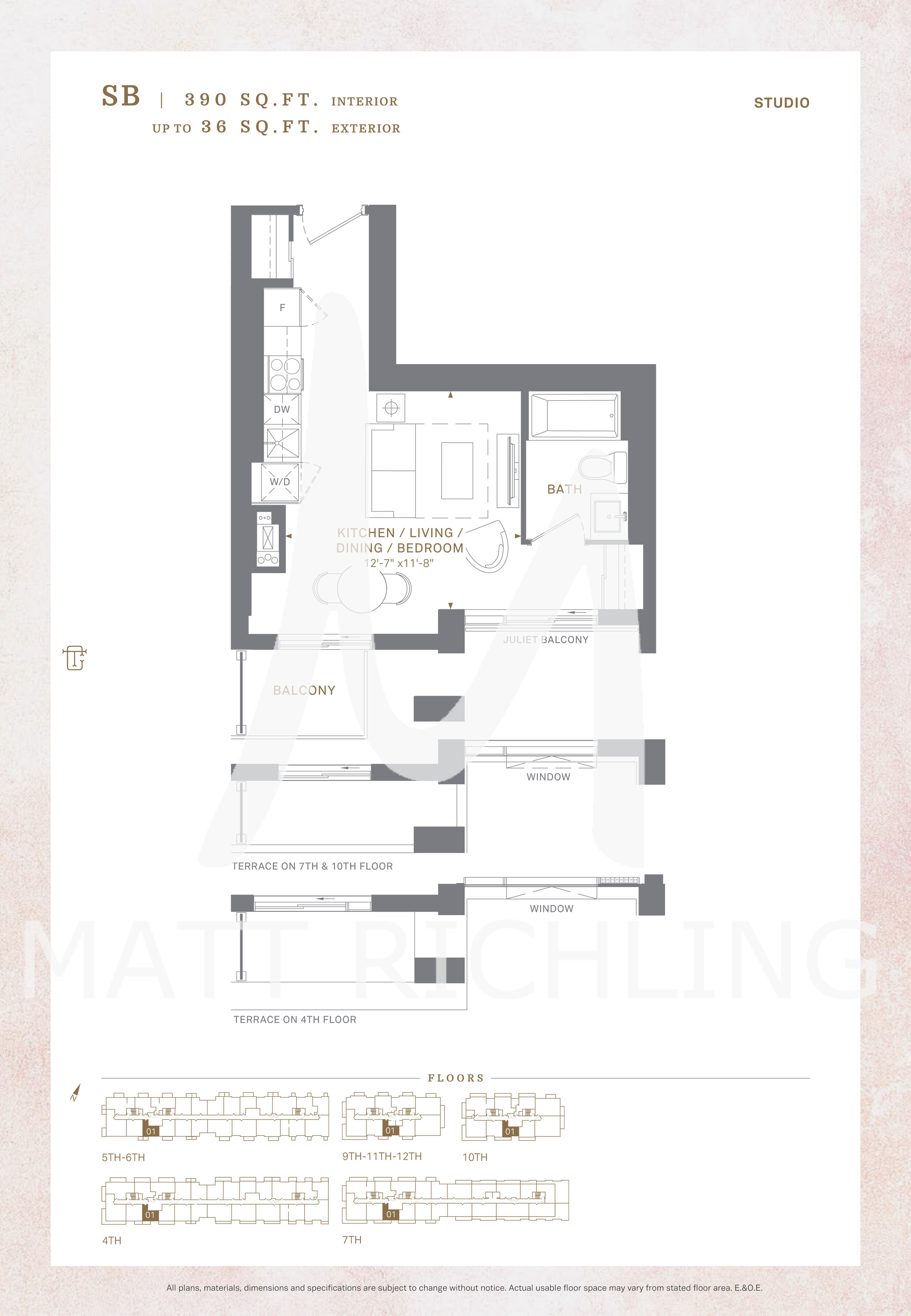

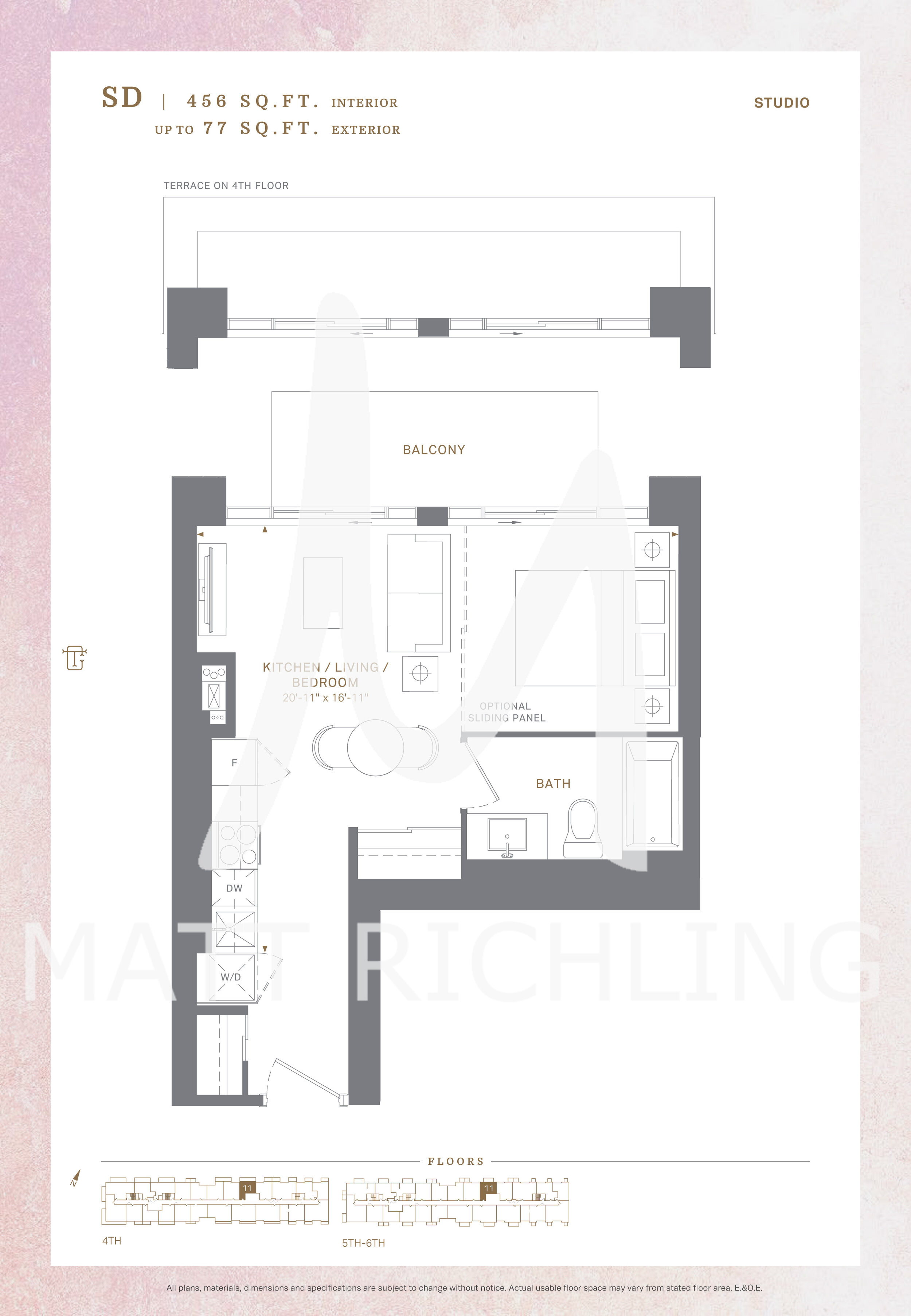

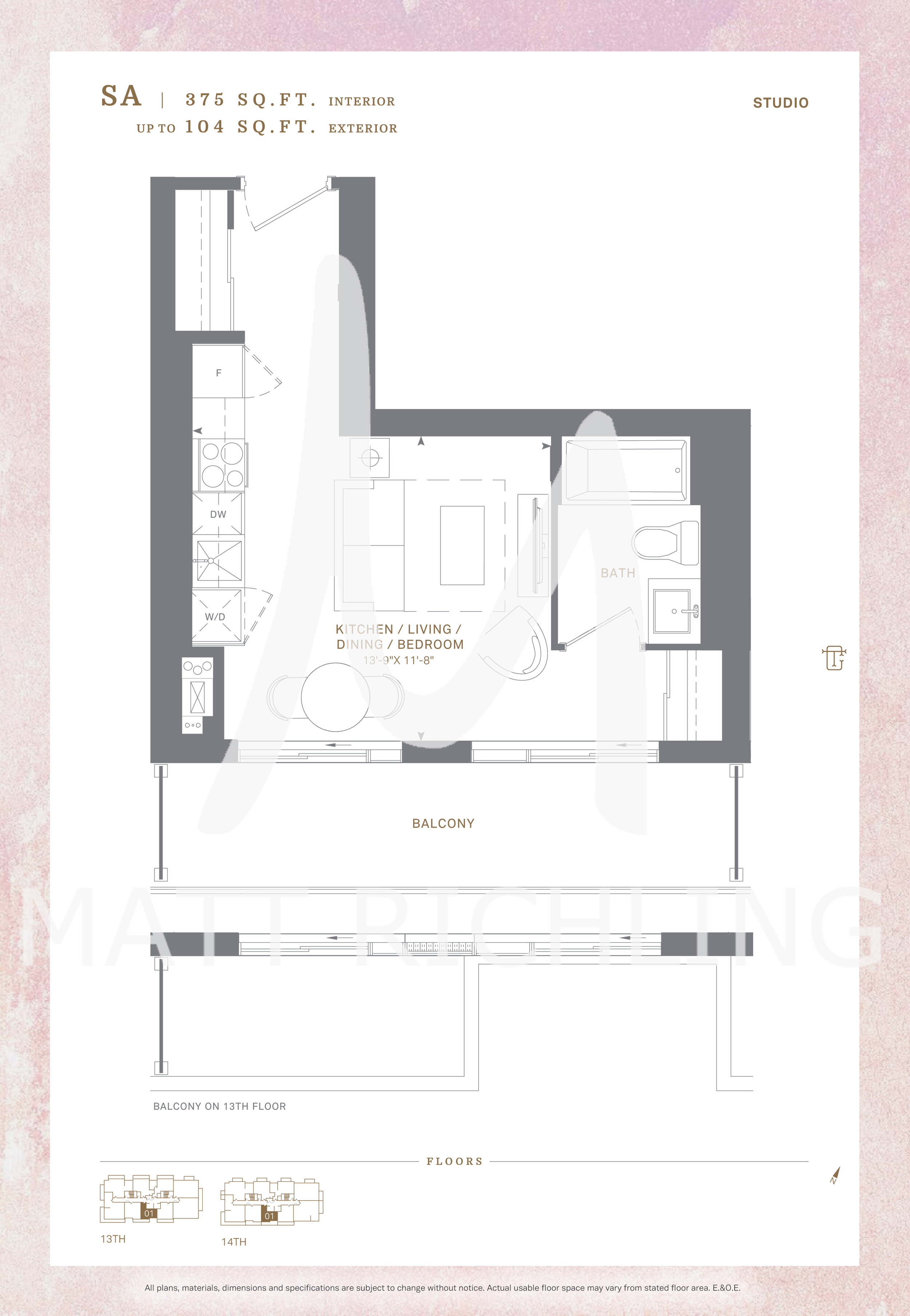

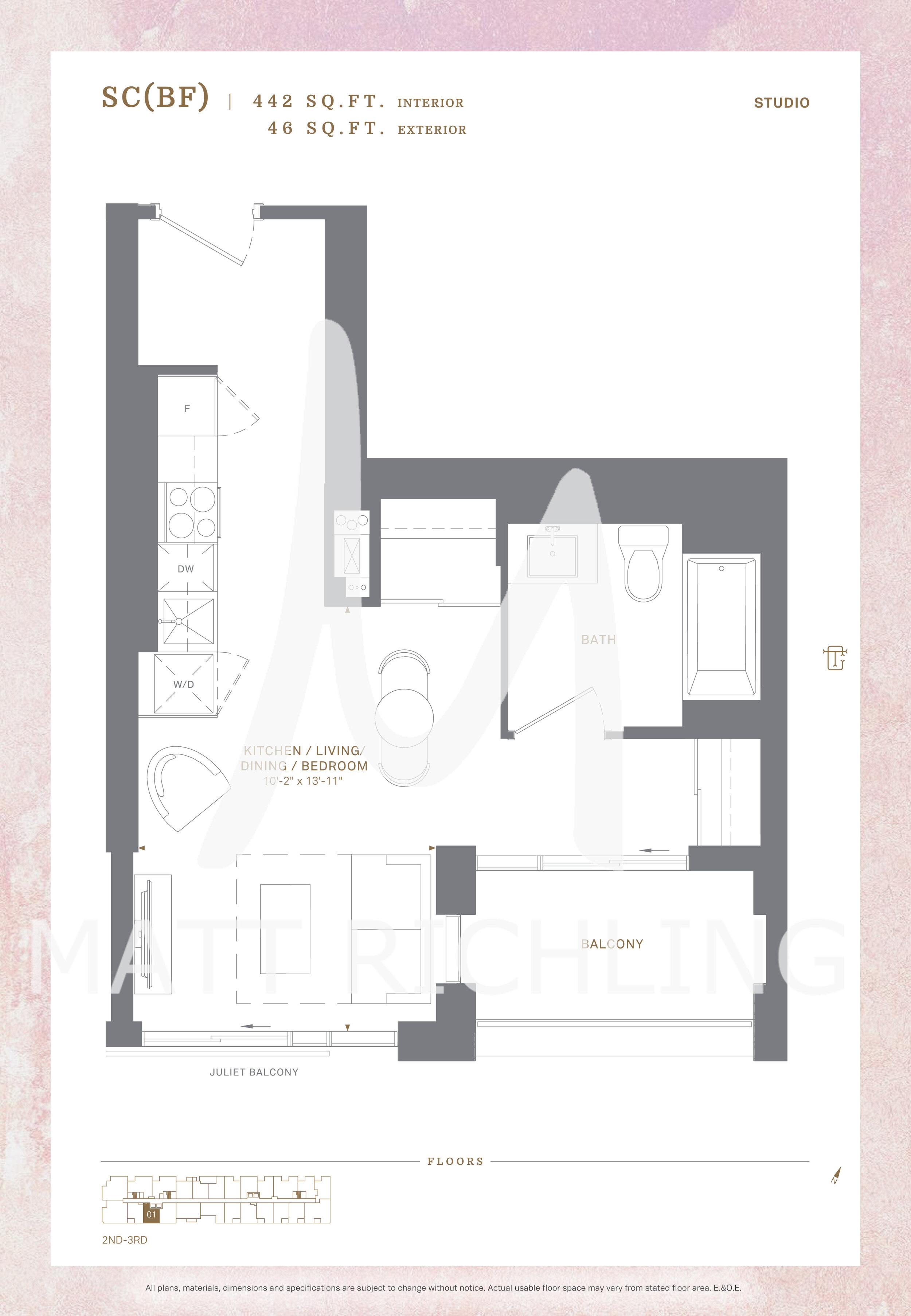

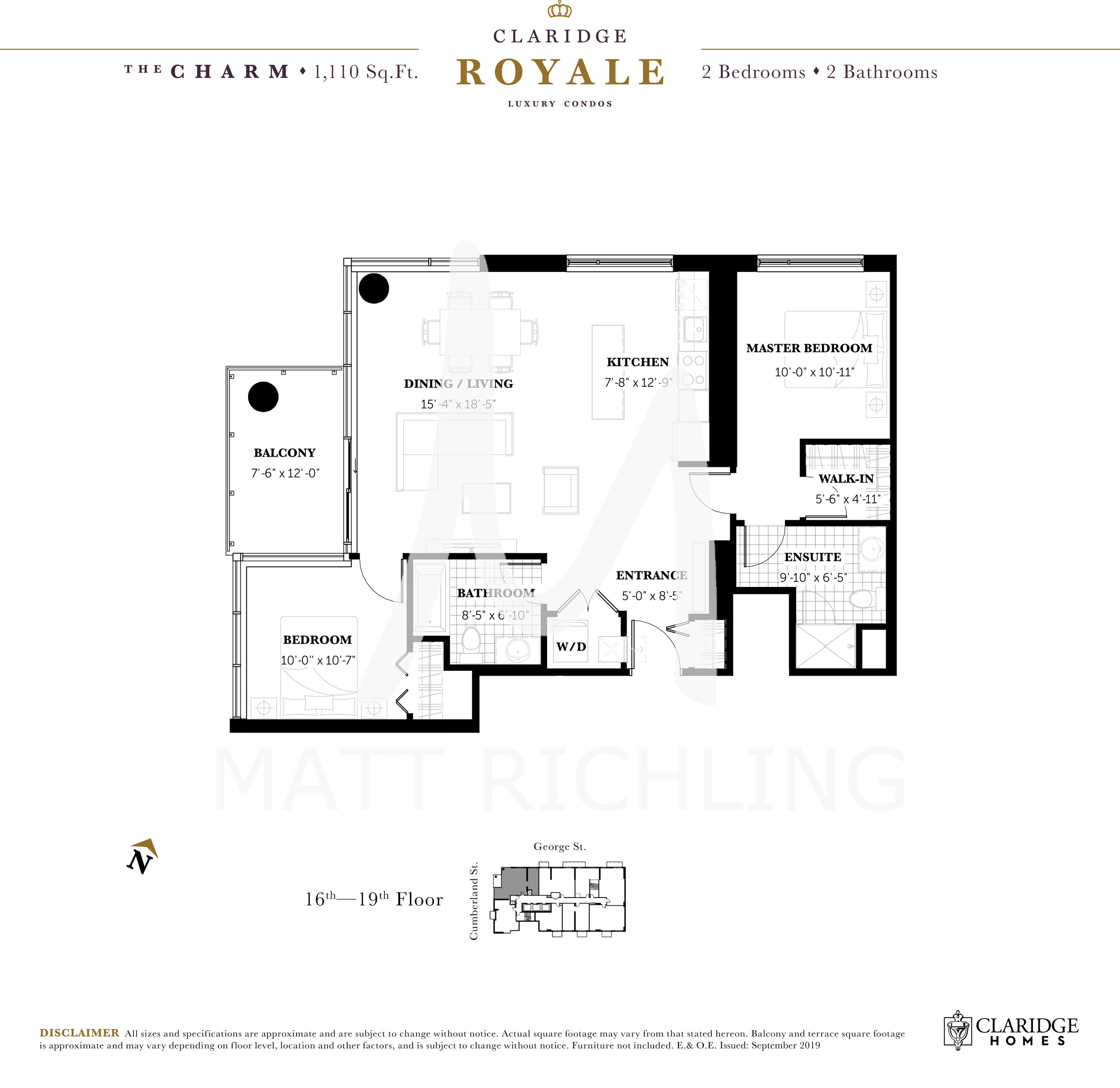

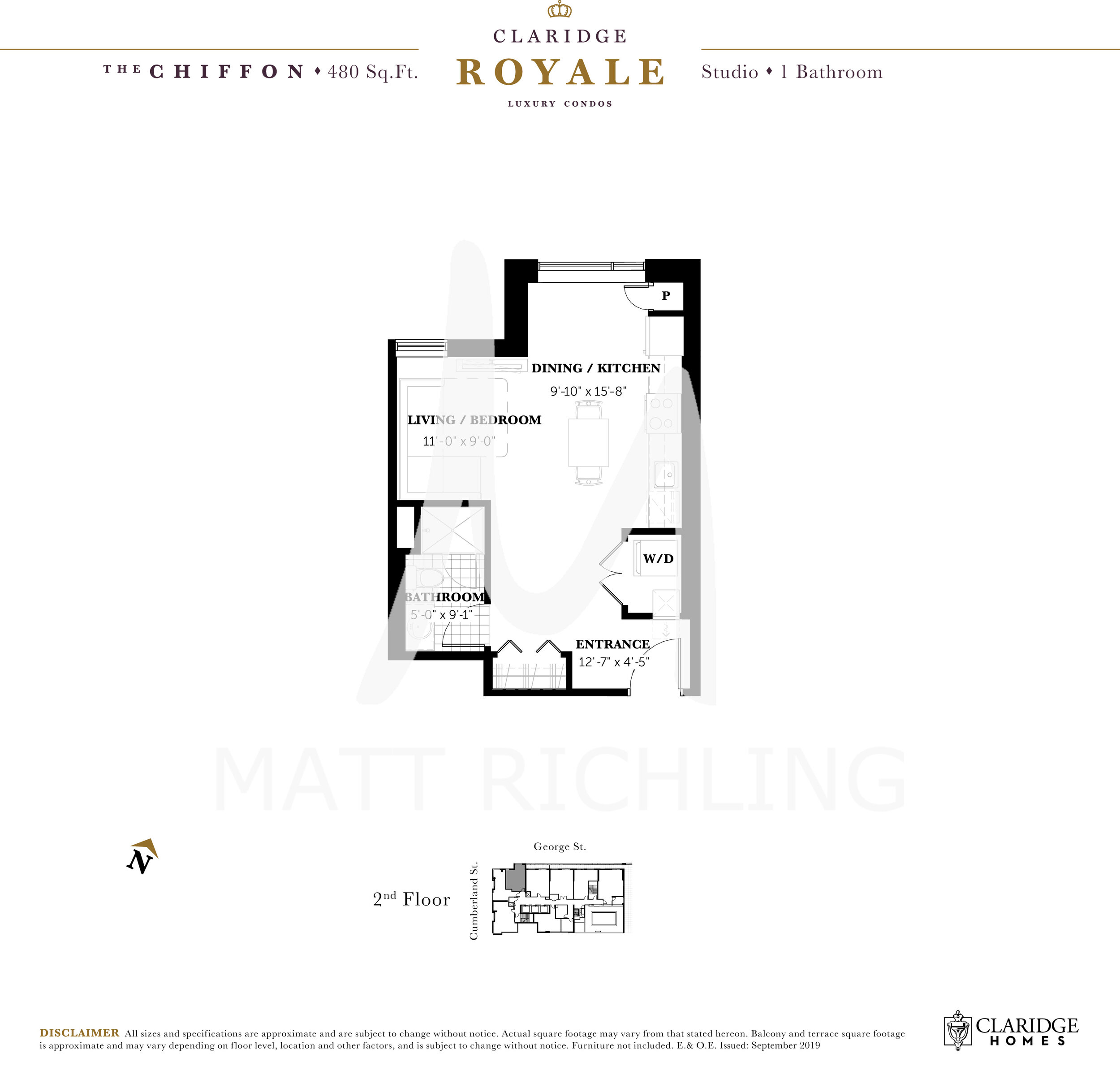

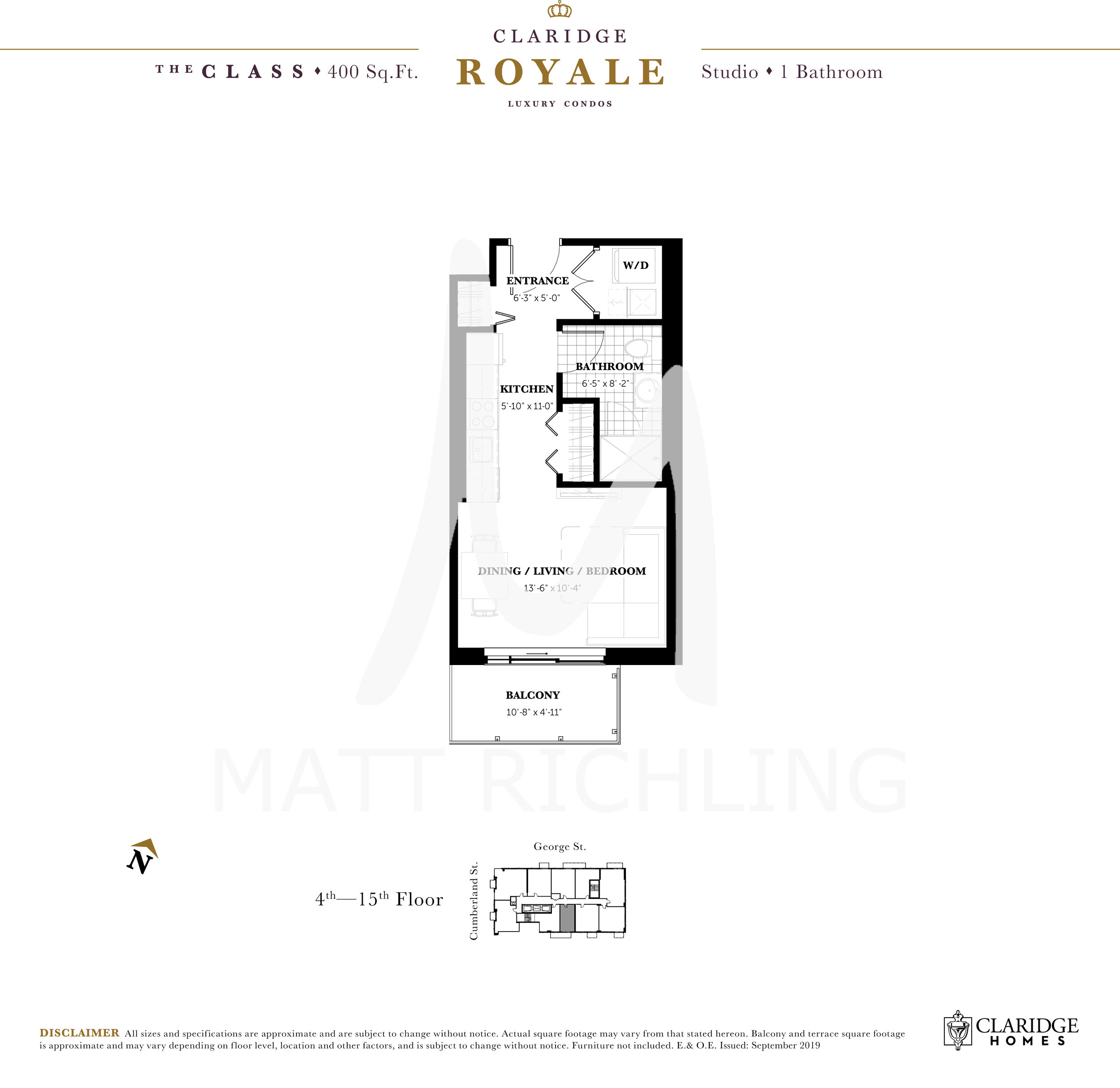

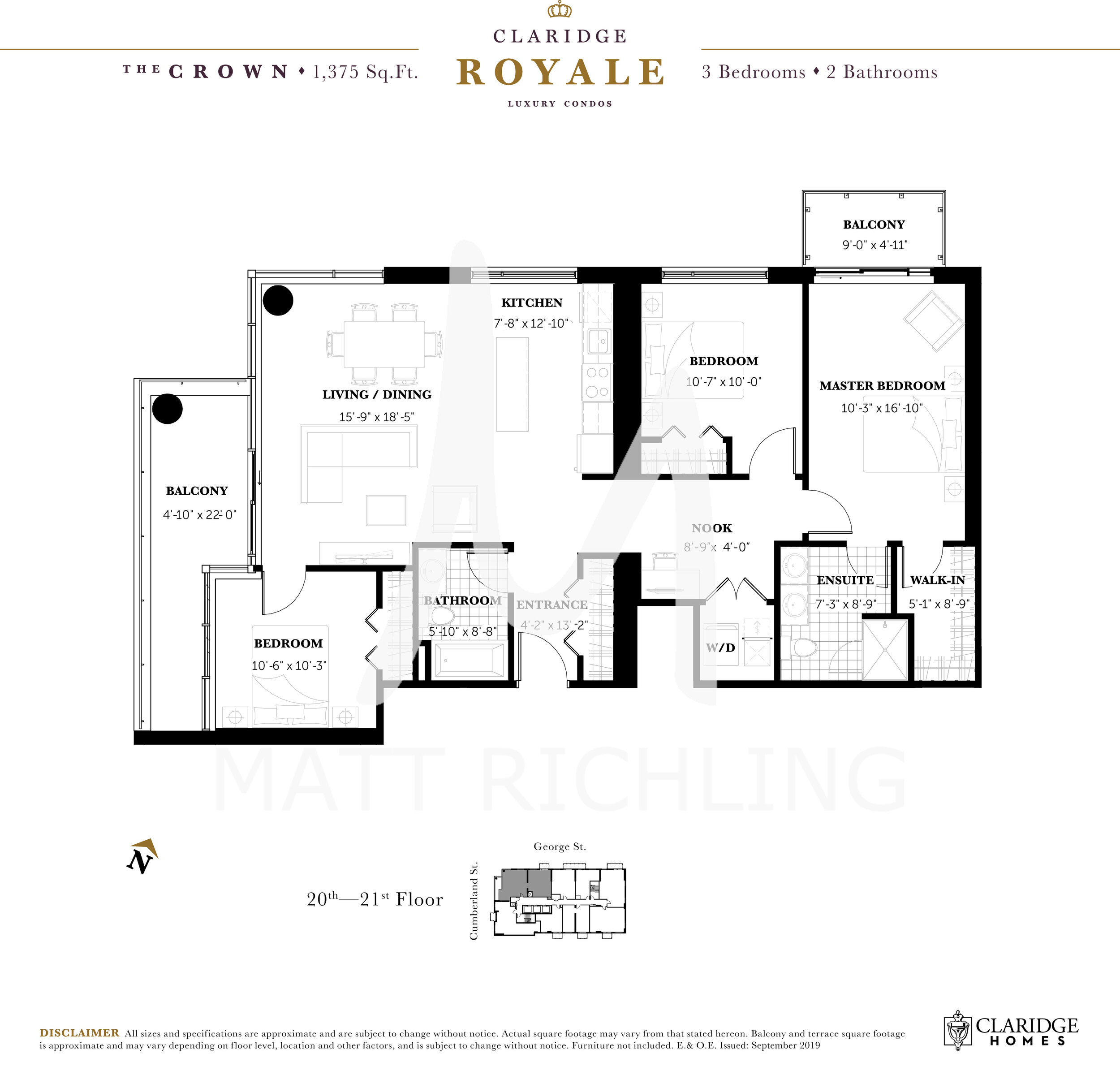

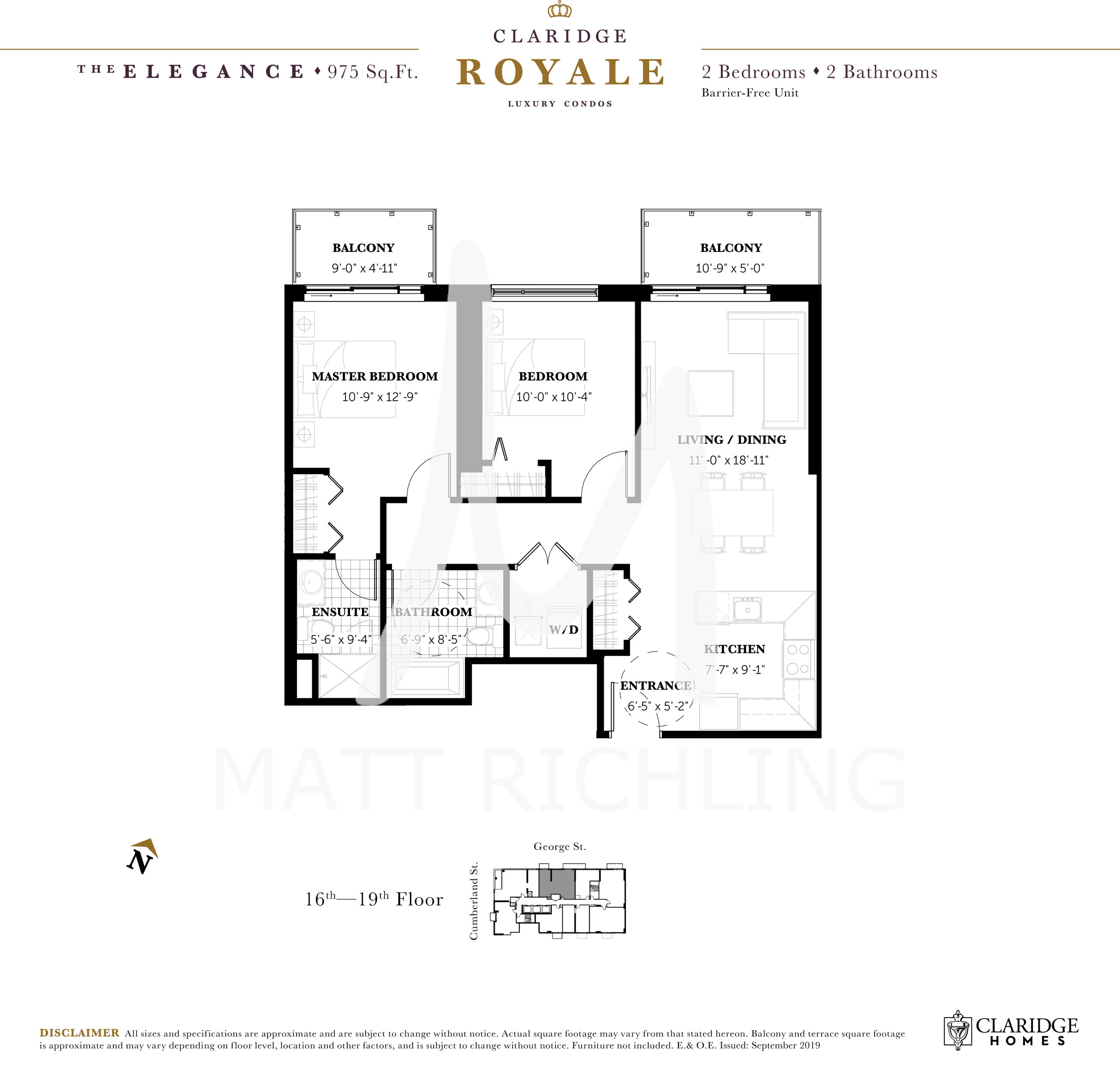

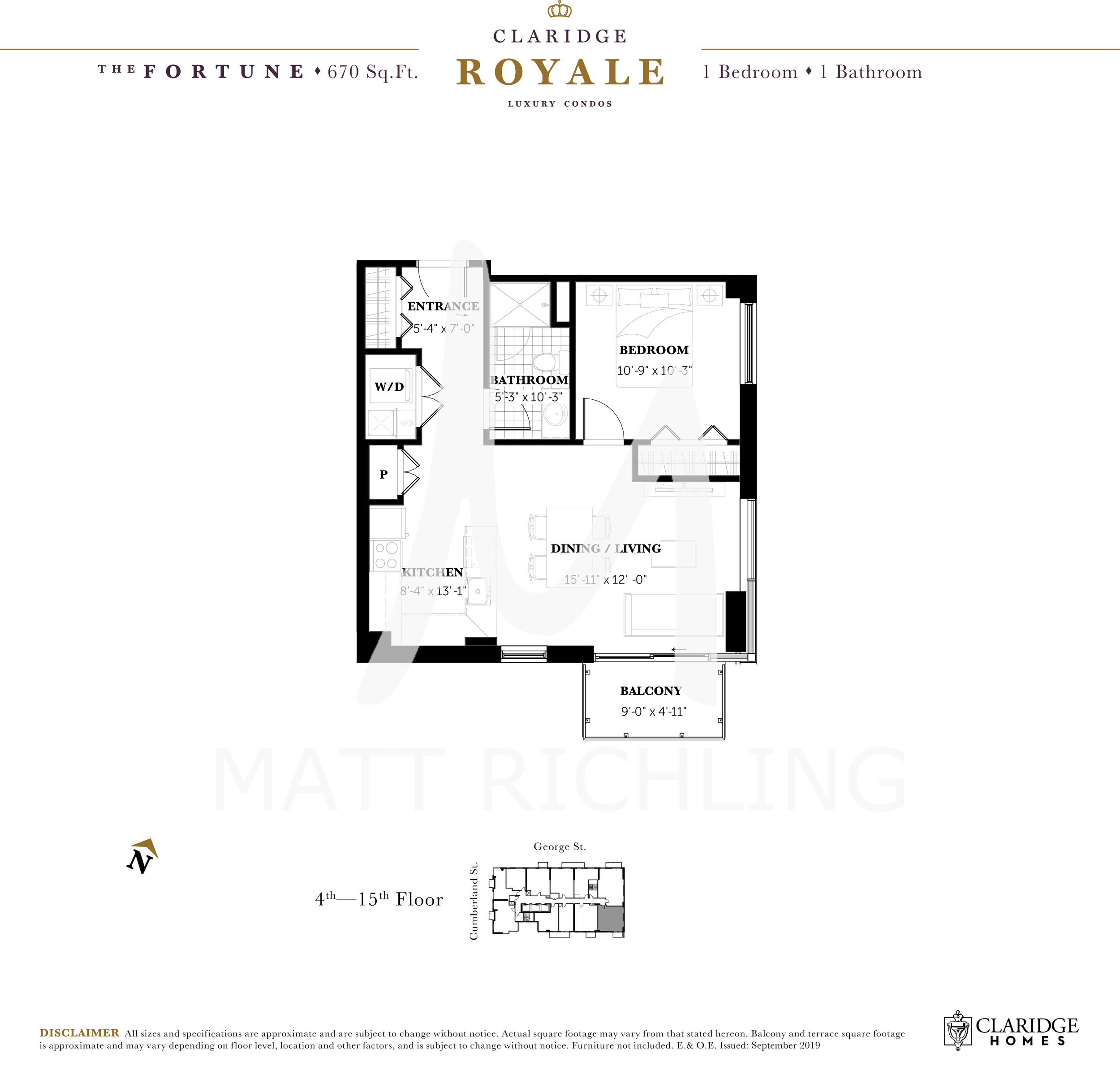

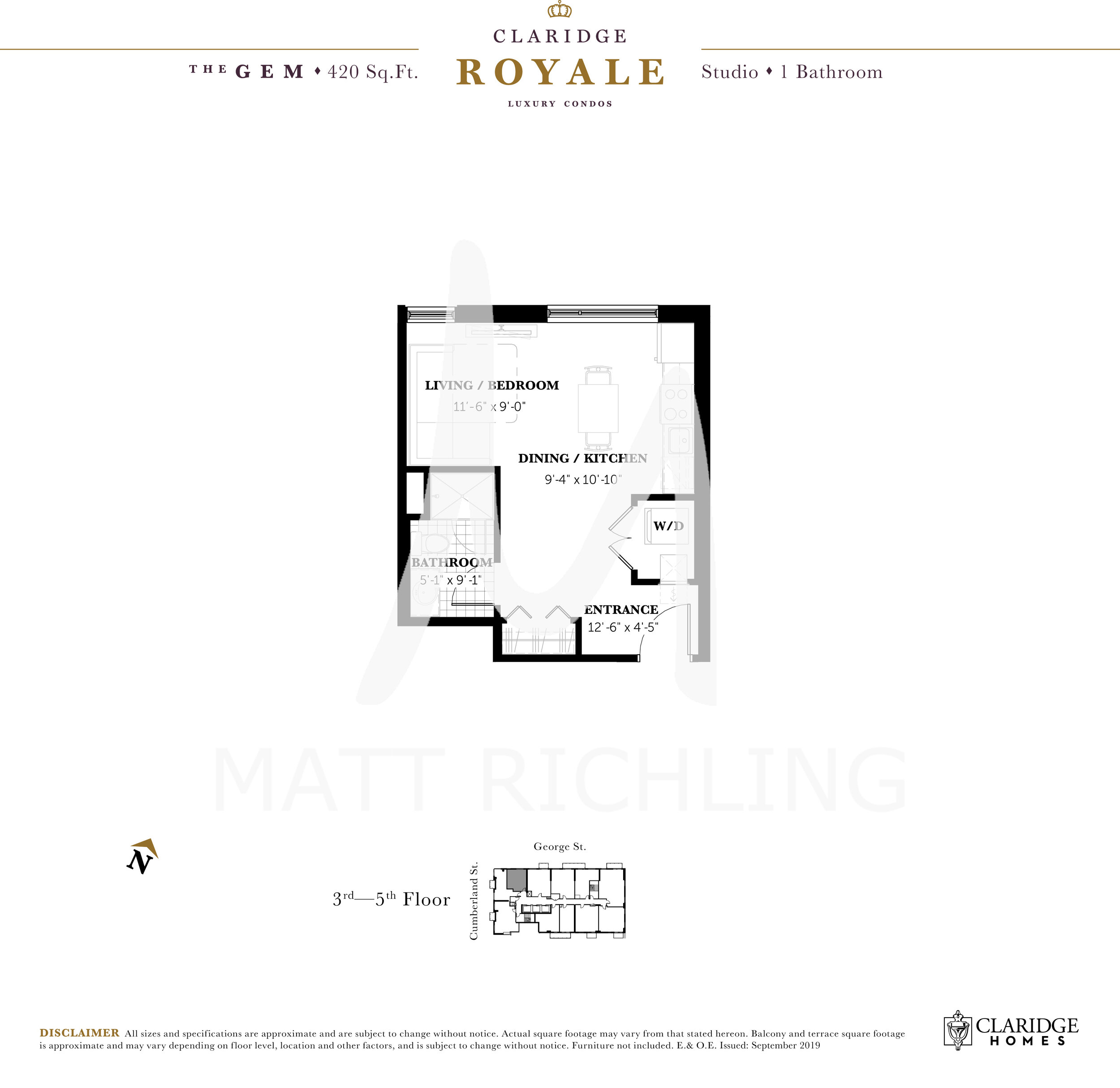

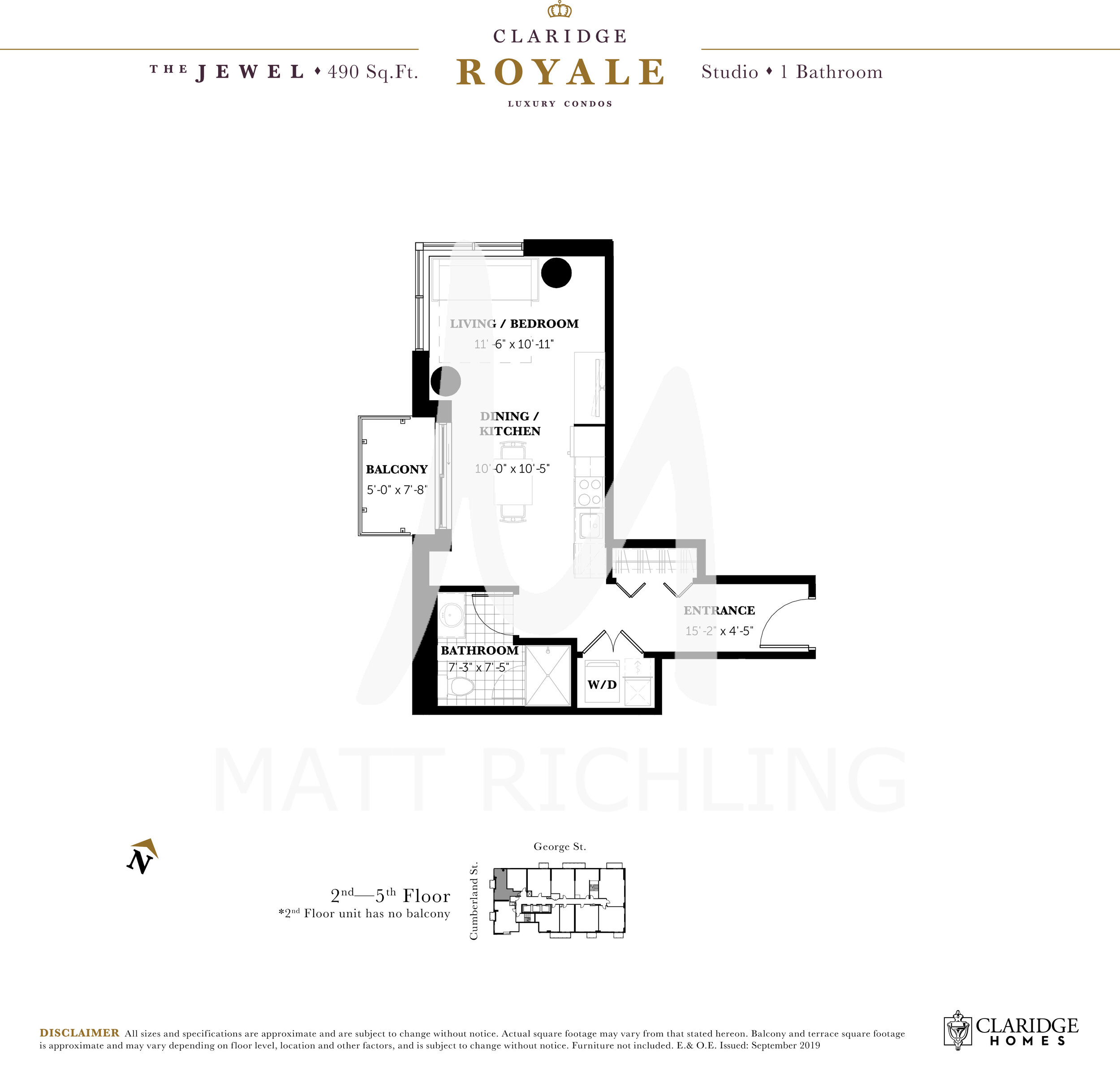

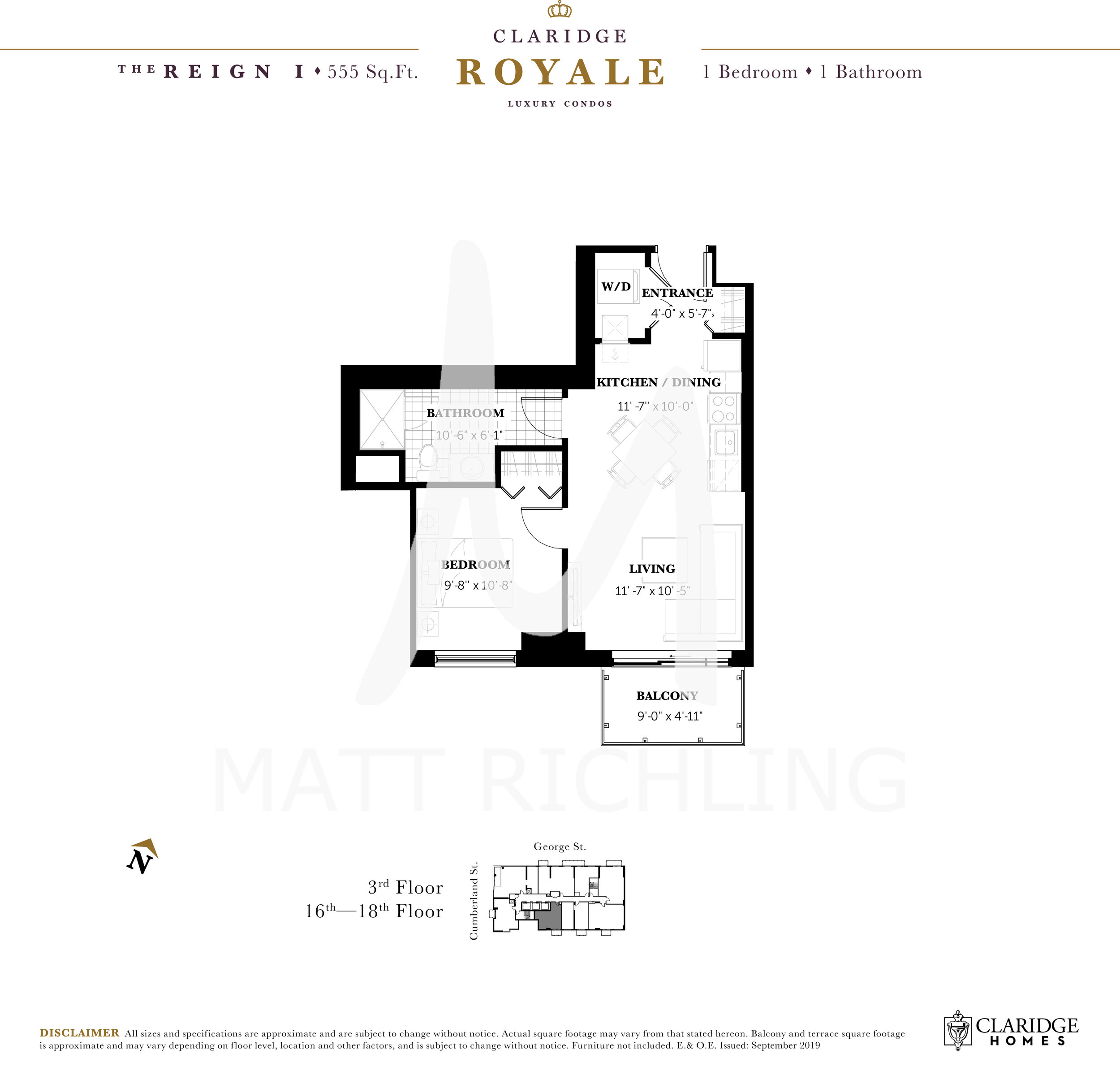

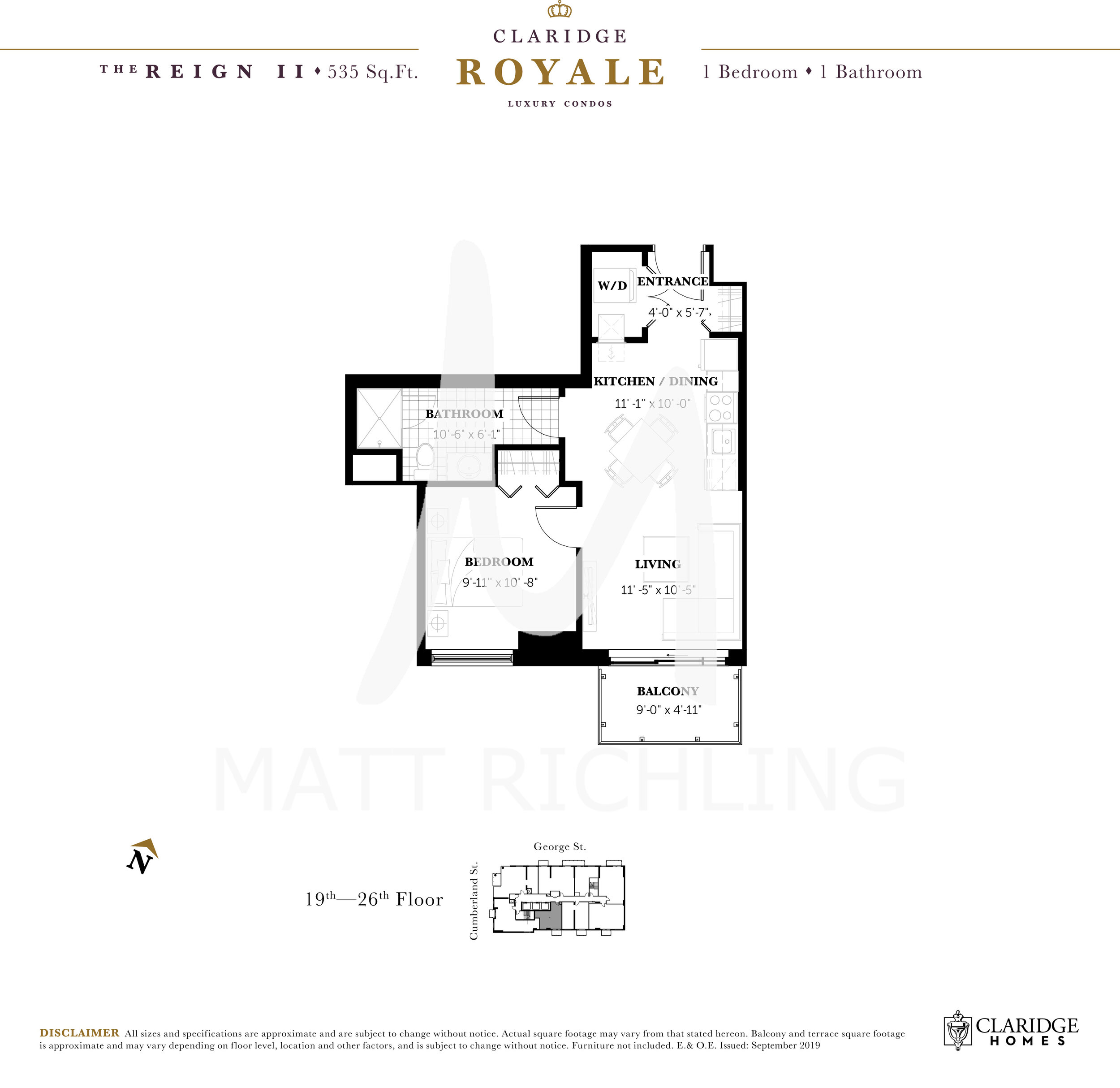

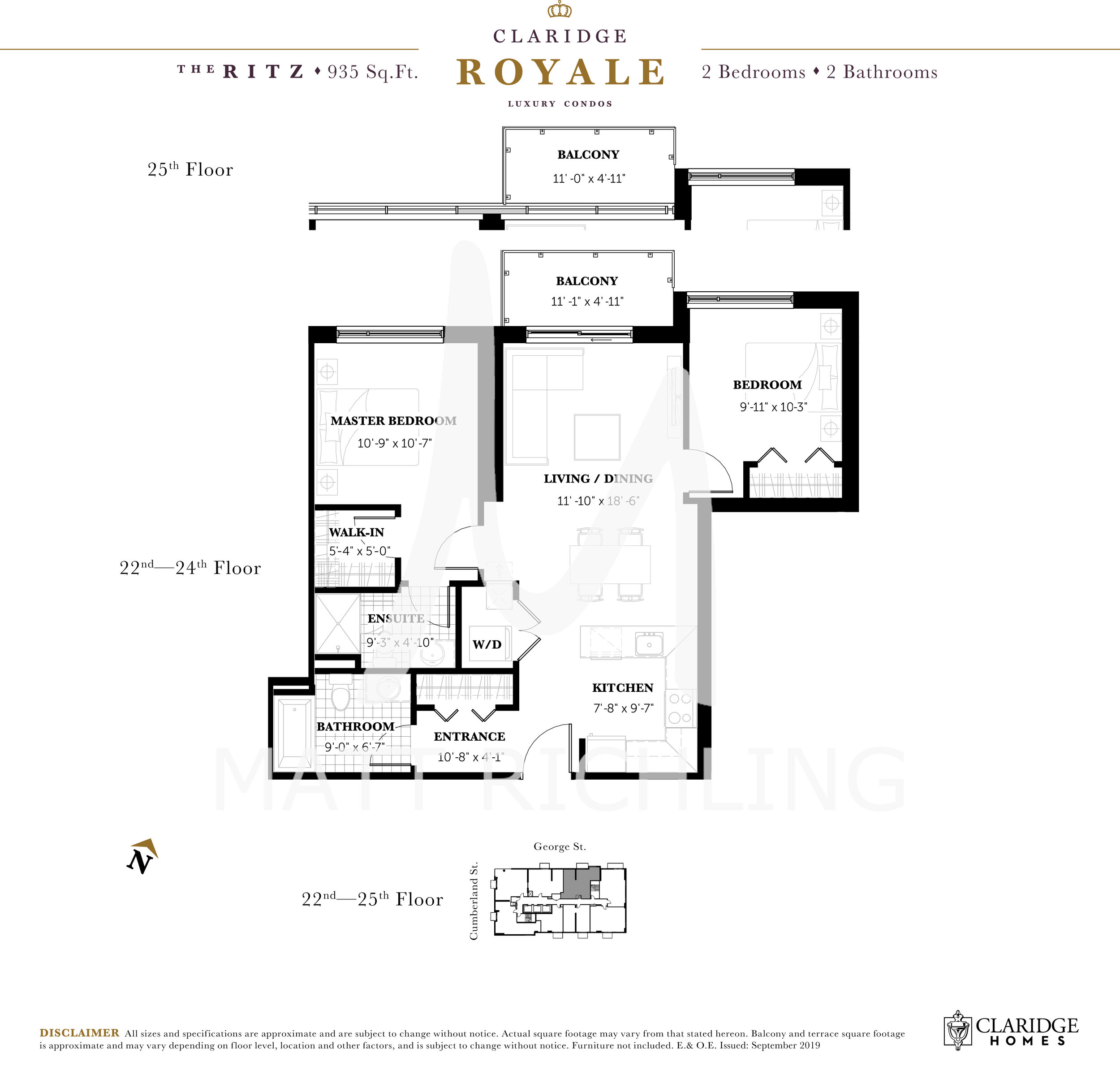

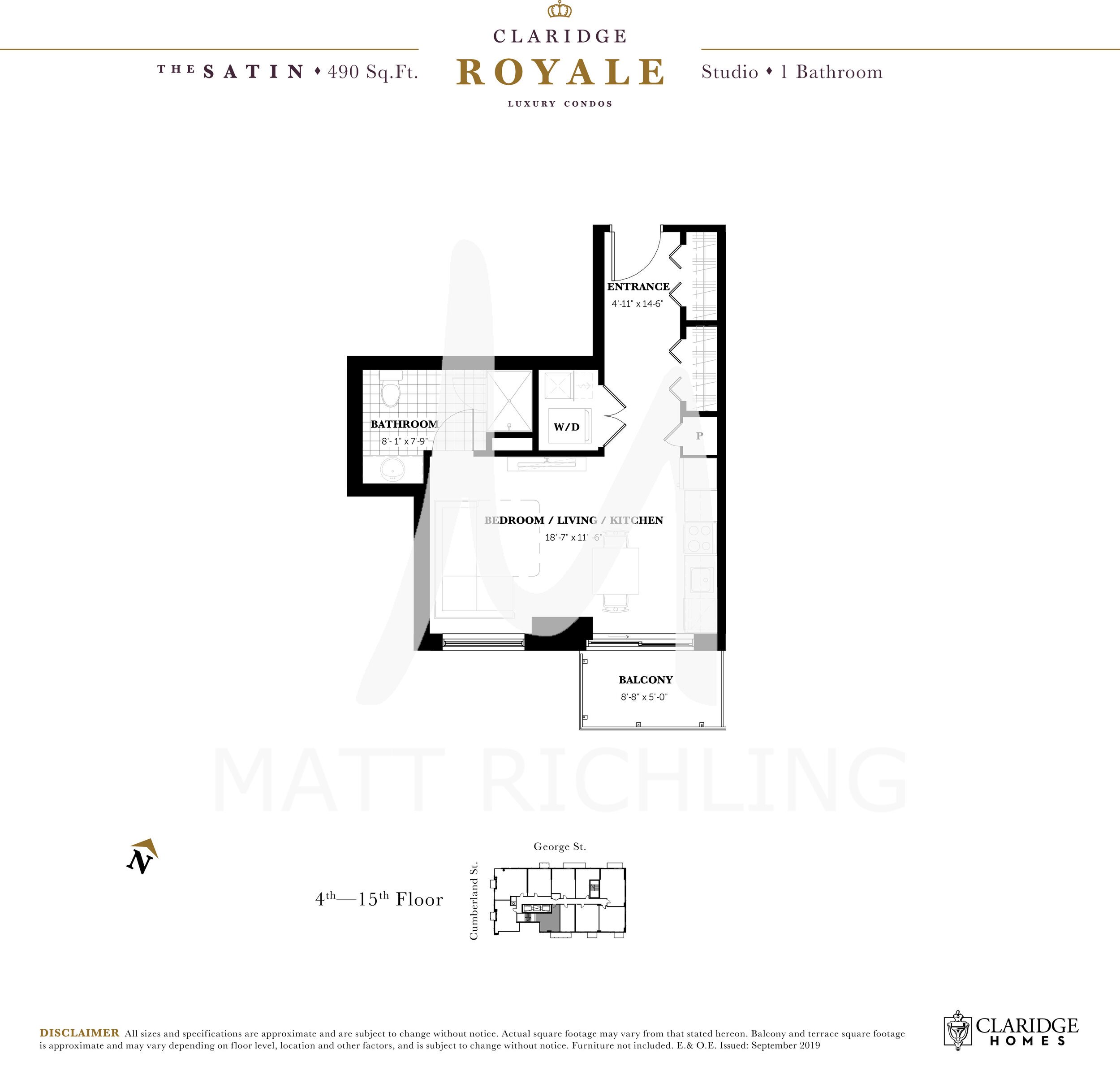

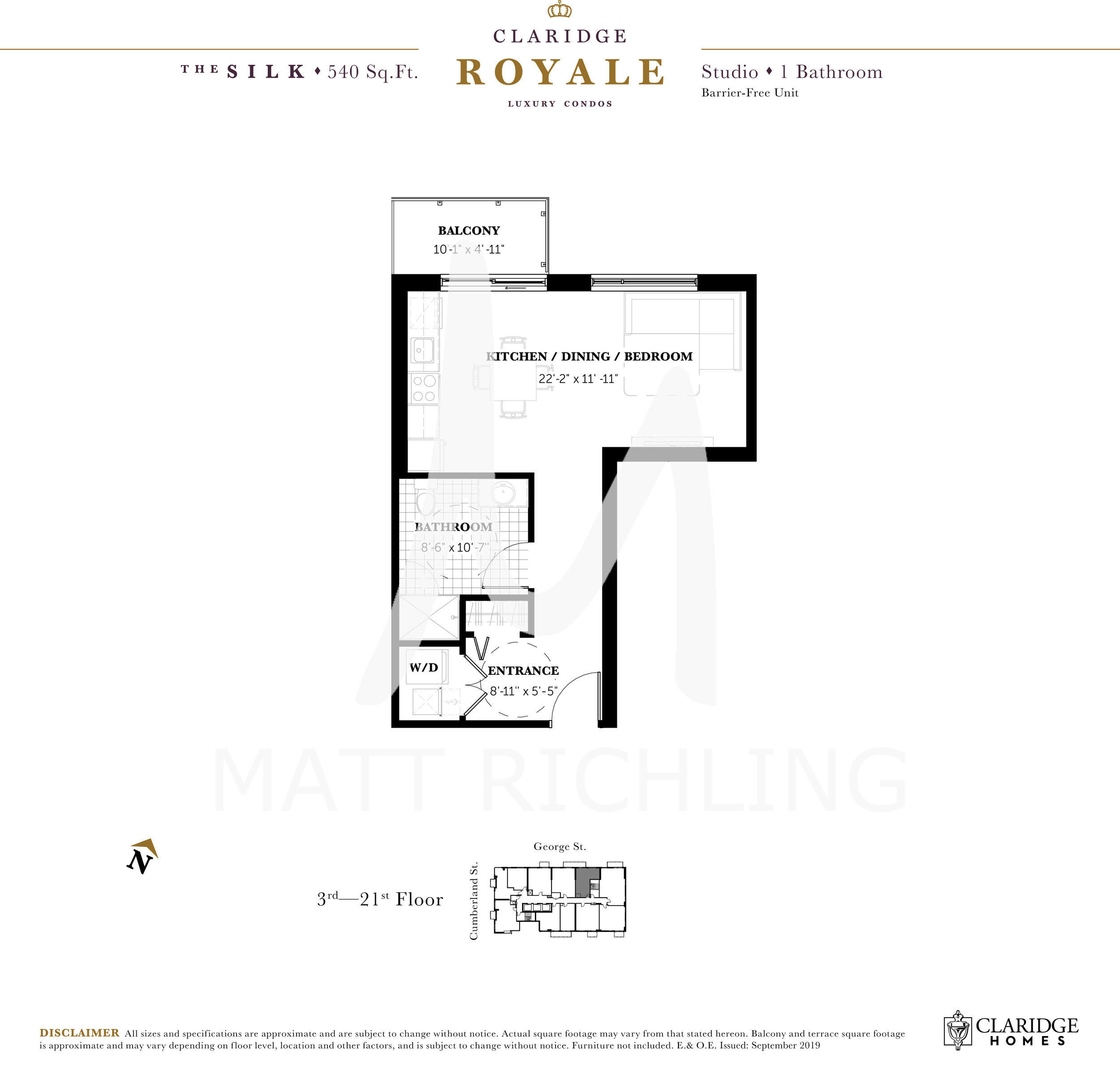

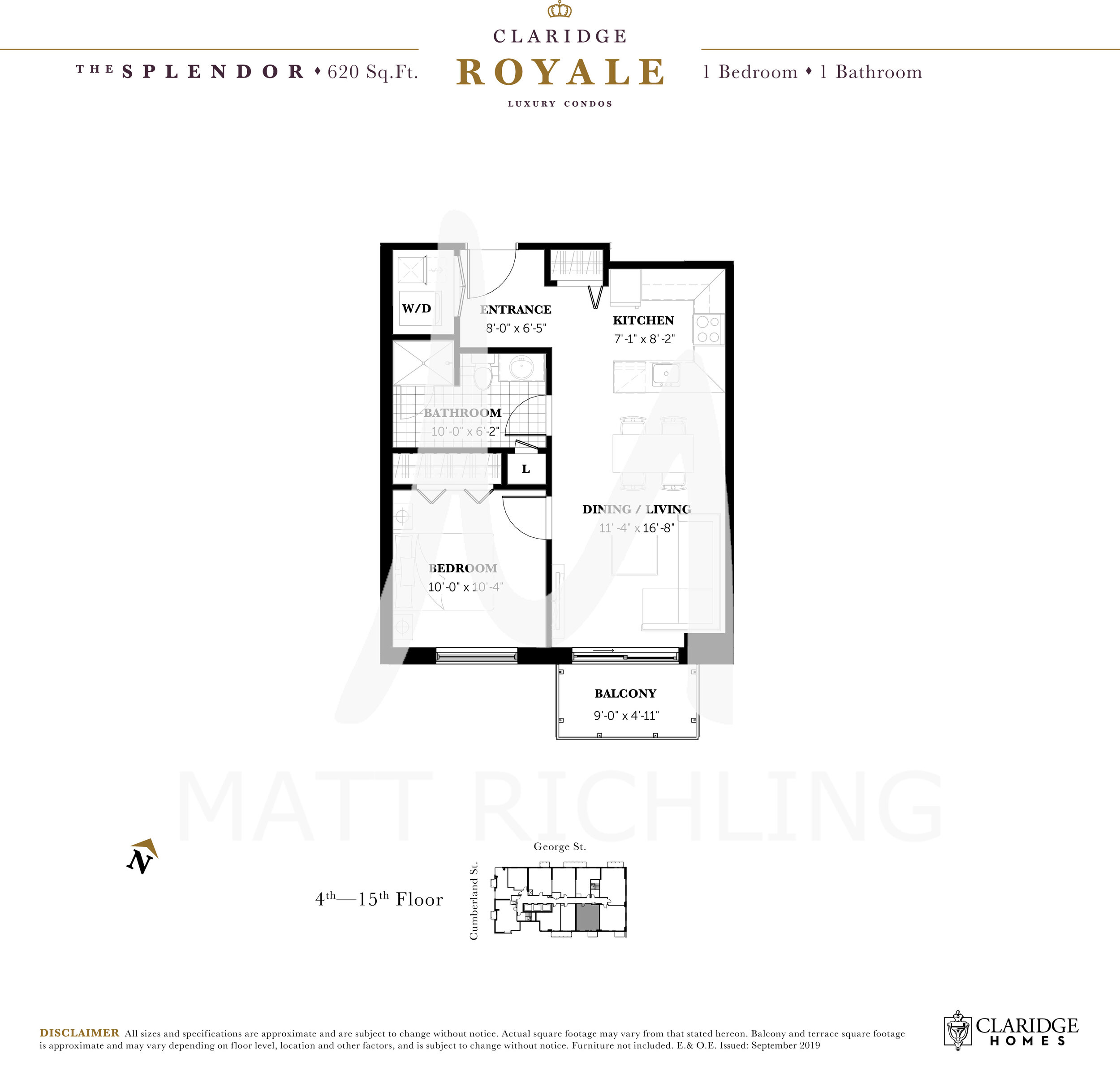

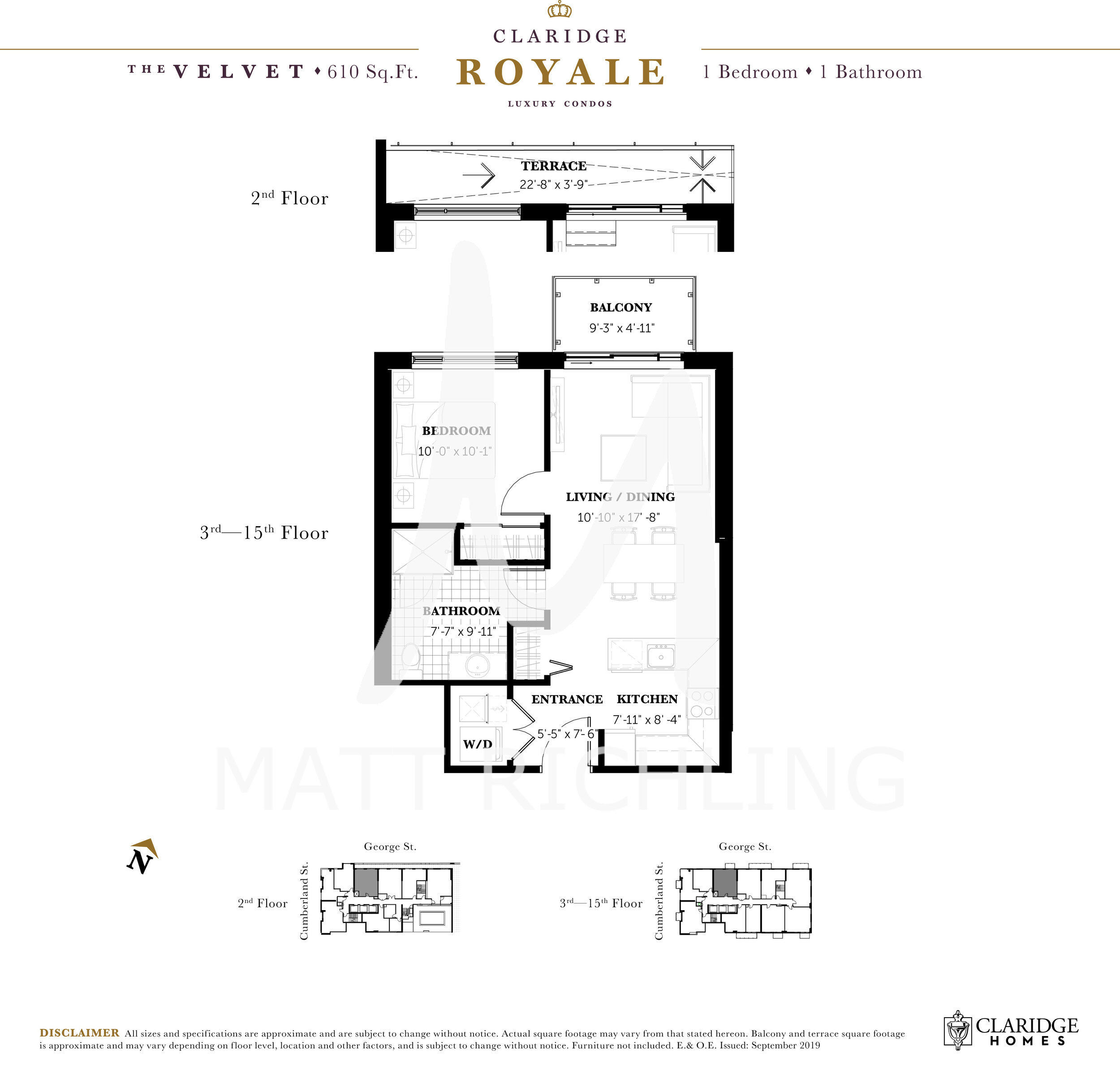

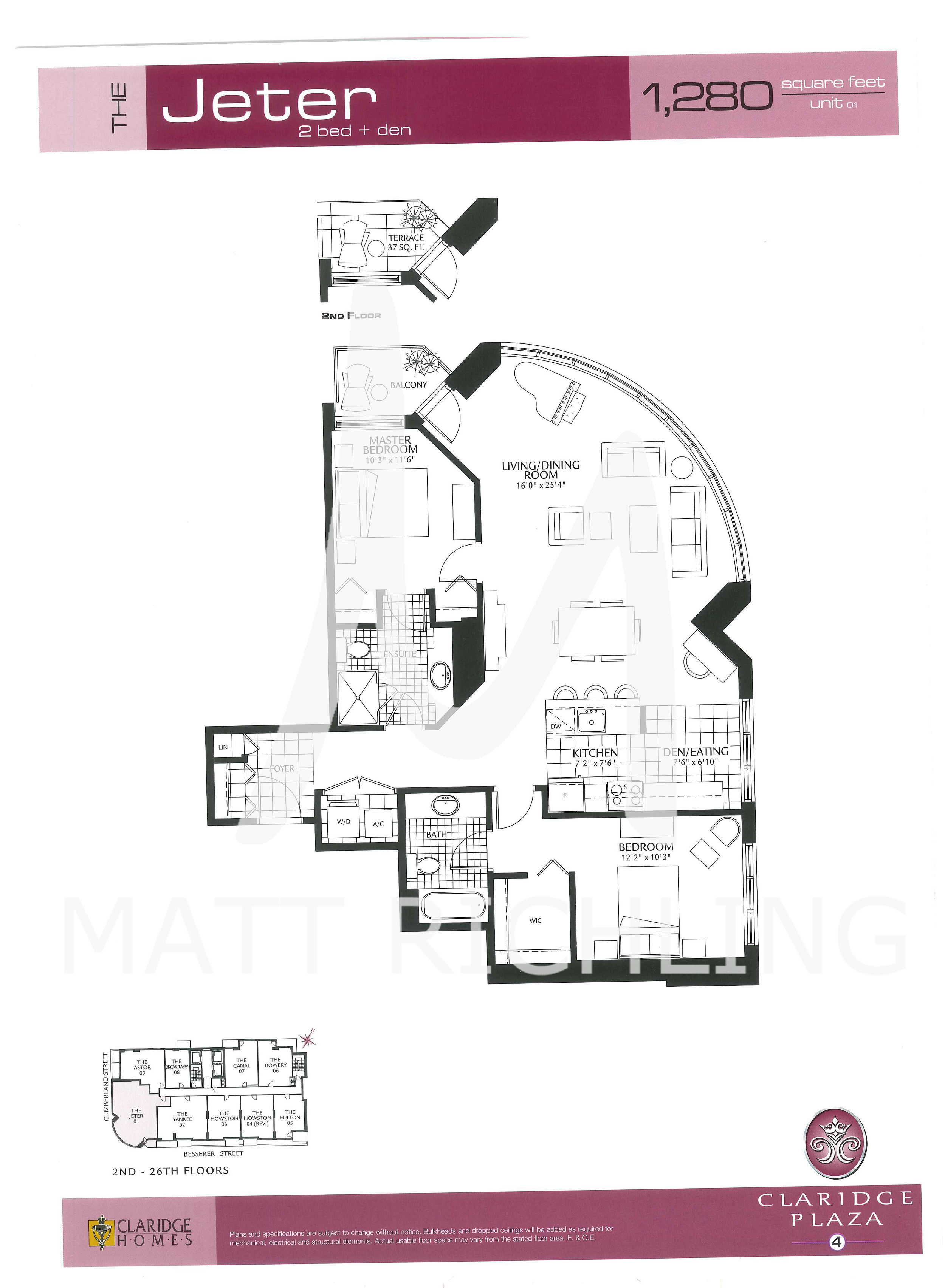

P: Exactly who is it designed for. The first time buyer(s) whose household income is under $120,000, that likely they probably have more 2-3 people in the family or they are looking at buying an area where prices are a little higher. Maybe that larger condo that they can’t currently get into or a bigger house where just the incentive helps pushes up their price range. That’s what it does, it gives everybody that additional 5% or 10% additional buying power and that’s a big difference in a lot of markets right? I think that the big thing there is what is it that you are buying and where are you buying it? And that will largely drive who benefits from this. So if you’re a first-time buyer in downtown Ottawa, on your own making $100,000 salary and you can only afford a smaller studio condo, and now with the incentive, you can afford a slightly larger one-bedroom condo. That difference in price might make a big difference for you because of where you want to live, which building, or size, or location, etc. Or if your family with two kids and you're looking at a townhouse that is $400,000 with a builder, now you are up to $450,000. $450,000 with certain builders a little bit out of the city in Ottawa, will almost get you into brand new single… almost. Right? For a lot of people, that's a huge difference going from an apartment to a townhouse or apartment to a brand new single.

M: What are the dates for the program?

P: The program started accepting applications as of September 2nd, 2019, and the property sale will need to close no earlier than November 1st, 2019. So you can start sending them in as of September 2nd but the closing date has to be November first or later. Which makes sense because November 1st is the fiscal date for the majority of the banks. You can see in the background changes like this is all starting line up with the banks and how they are implemented this with their policies, saying “ok we will start doing this effective November 1st which is the new fiscal year for all the banks”.

M: What can’t the incentive be used to buy?

P: It has to be owner-occupied, and the primary residence (not an investment property, not a cottage or second residence). That is the only thing this is built for. This is the government's response to “Hey, I'm 30, I work a good job but I can’t afford what I am trying to buy”, “Ok, we will help you a little, this is how we are going to help you”. Which makes sense because the government is not getting involved with more than 5% of the market value, which is good as a taxpayer and as parents, you don’t want to be underwriting future generation debt, so that’s a good thing. And it’s smart doing the 10% of the new home builders stuff because chances are that you are running a model where it’s a new home build you are probably on a two year wait anyways, so by that time the true property value will be 5% higher because of appreciation so it’s a bit of a speculative move, but really the end value position is the same because the value has gone up on what they bought it for from the builder vs from the market value is.

M: Is the First Time Home Buyers Incentive a good deal?

P: It’s so hard to answer that because we don’t have anything to compare it to. We have never seen anything like this. My personal opinion is yes, it’s as much as the government wants to be involved in the financing of real estate. It’s to help those people who are in that lower bracket because again, you look on MLS in Dartmouth NS, the difference between $400,000 and $500,000 buying power, left and right field. That’s going to help those people. In Toronto or Ottawa? Again how many of those buyers are going to be under that $120,000 cut-off, this is a small city bigger house program to me, that is what I see or downtown large condo just a little more sqft, instead of a studio, you are now in a one-bedroom.

M: What are the issues with the incentive, or downsides for the buyer to be aware of?

P: The amount you will owe the government back is proportional to your property value, so if the property goes up by $100,000 then $5,000 of that goes back to the government. You don’t get to keep the whole amount. The downside to the taxpayer would be if the market turned, that the taxpayer would be on the hook for a bunch of negative equity if the price is pulled back because if we’ve gone down proportionally then we’ve gone down. Because if you’ve lost $100,000 then 5% of that is $5,000 so you can take $5,000 of the grant amount that was given to you because it’s dropped in value so whose that $5,000 going to fall on? Taxpayer.

M: Why is the government doing this incentive?

P: They have to address the huge amount of Canadian citizens who are saying that I can’t afford to buy what I want to buy, in this area that I want to live. The idea that you want to live where you work, and that we need to as a society have affordable housing in all areas regardless of where that is. That’s the ideal model, the problem with is the reality of big city costs.

M: Will this help affordability?

P: I think it will help the single person downtown Ottawa that wants to from the studio to a condo but the way that they are very much restricting it is that $120,000 income cap. There’s a majority of households that you and I cross together that are making more money than $120,000. The majority of buyers this does not entertain, not because they don't want it or because it’s a bad program, they just won’t qualify because they make too much as a household. It’s really going to help smaller communities, located outside of major area’s.

M: Flash forward five years, it is currently 2024 - was this a good thing to do? As the condo owner?

P: There’s a reason you went with the incentive. You didn’t stumble into it, you went into it because it allowed you to buy something you couldn’t afford to buy before. Even if that difference is marginal at $20-30,000, it still got you to that $20-$30,000 more than you needed. Are you happy? I’ll pull out my crystal ball and see what the market says in 5 years. Across Canada, we are slowing down. In Ottawa and Montreal and a couple of other key pockets just keeps going. I think that is local economics vs cross Canada. Cross Canada I do believe we will continue to consolidate. Locally in Ottawa, I think we are going to go on a bit of a run still for another two or three years and we will probably have a long flatline. I don’t think prices will dip but I can see a nice four to five year flat coming from like 2021/2022 to 2026/2027 just a nice flat where certain neighbourhoods go up by 2% others drop by 2%.

M: What about Ottawa specifically?

P: In Ottawa, everything for me depends on the towers downtown, everything depends on that because that will drive how the city goes. The faster you get big towers downtown the more pressure will be taken off of builders and suburbia so that they can carry inventory. It’s not healthy for any new builder to not carry inventory. It’s like going to a car dealership where they don’t have inventory, it doesn’t make any sense. It’s not the purpose. The purpose is to go in and buy the inventory for future closings. That’s always the cycle, right? There’s no resale, you go to a new build, but not here. There are no resales, and no new build, so that's why the values are popping so much because there’s nothing feeding the cycle, plus our crazy low vacancy rates.

For more information about financing and how it affects your purchase or sale, reach out to Peter by visiting CapitalHomeLending.ca.